The Assembly Place - Balloting Results

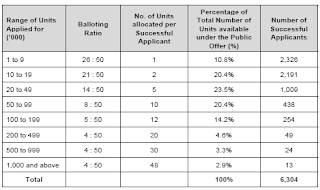

This is probably one of the most usual press releases that went alongside the SGX announcement of the balloting results. The Company released a full presentation deck , which is actually quite informative, with information of upcoming pipeline etc (probably the Company felt that it is safer to release this after the IPO closes and not before). The balloting table is as follows: The IPO has drawn strong interest from prominent institutional funds such as Avanda Investment Management (as investment manager for and on behalf of its fund(s)) and Lion Global Investors Limited (as investment manager for and on behalf of its clients), along with prominent investors, including Mr Han Seng Juan, Mr Rudolf Jurgen August Rolles and Mr Chong Soon Kong @ Chi Suim2 , underscoring strong confidence in TAP's investment proposition. Separate from the Invitation, cornerstone investors, namely Apricot Capital Pte. Ltd., Asdew Acquisitions Pte. Ltd., Cache Capital Pte. Ltd., ICH Synergrowth Fun...

Comments

[[ anonymous 7 ]]

Congrats to anyone who didn't stag MapleTree China only then to find a problem getting hold of enough CRT.

- Shu

Thanks Mr IPO for your expert analysis

All the best for those who got it.

Huat Ah!

Will buy some on open today, anyone selling?

Mr Ipo,

At least you are luckier you still have 4 lots.

Will you be selling and at what price ???

BTW: Phuket Travelling site is a really good guide. I found it helpful and I thought that I would share it Phuket Guide, Infomation, you can find, check cheap ticket, best hotel from here | www.phukettravelling.com

[[ anonymous 7 ]]

re : Mr. IPO said...

Not selling. I was hoping to get more shares from public tranche to keep for the yield

==========

actually, given the increase in property taxes, it is wise to collect whatever safe dividends can be found.

S$1000 in property tax means around S$20,000 to S$25,000 in MapleTree China or CRT.

For S$9000 in annual property tax, one has to have around S$200,000 in these REITS / Trusts.

High property prices are no that fun after all, right? Are my calculations correct.

Usually distributions from REIT to Singapore unit holders are free of tax whereas if you own a real property, you have to pay property tax and taxes on rental income.

[[ anonymous 7 ]]

paying property tax (on physical real estate) from dividends from REIT (distributions) is a beautiful arrangement, ... that's what I'm suggesting.