Asian Pay Television Trust ("APTT") announced the following:

- Its public tranche of 70m shares was 5.8x subscribed.

- Its placement tranche of 530.5m shares was 5.2x subscribed.

In addition, approximately 63.8% MIIF shareholders "elected" to receive APTT units instead of cash. That is quite a high acceptance ratio but i understand the "default option" is to receive units. One of my concern is that these MIIF shareholders may create an overhang by trying to sell their APTT units.

The over-allotment of 71.84m units were triggered and these will be used to stabilize the share price if it falls below 97c.

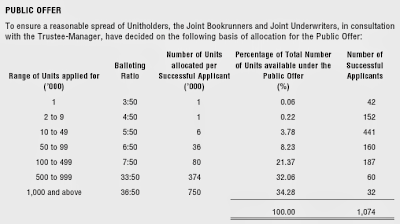

Balloting Results

You will notice a few phenomenon.

(1) It is very difficult to get the units. The probability of getting the shares are are very poor.

(2) You will get a meaningful allocation if you manage to get some (for those who applied for 10 lots and above).

In other words, they didn't try to 'spread out' the shareholders base, which in my view, is good for the counter.

A few asset management firms also appeared in the announcement for being allocated shares.

The shares will start trading tomorrow 29 May 2013 at 2pm.

Did Mr IPO manage to get any shares from the ATM? Stay tuned. The results will only be out after 7pm. DBS computer works slower than others.

Subsequent update: Mr IPO's result

Two accounts, one successful one not. Both applied for 50 lots each. Let's see if it is make a killing or get killed tomorrow. ^_^ I think it will be a hit and run for me, my investment thesis still remain.

Comments

I just chanced upon your blog and learnt a lot.

Will you be sharing information on the IPO of SPH Reits?

Thanks!

Cos I understand approval is just given. :)

Those who applied for 100 lots or 1,000 lots where given about 70% of their application will have sleepless night.

1 cent down represents a loss of $7,000.

Wow! You got 36 lots! You are really lucky.

I think you will make a killing tomorrow. Congratulations!

A gain of 10c per share means a cool $3,600 red packet.

I applied for 201 lots and got nothing. :(

Can only tell if lucky or not tomorrow. I hope US tonight can help rally a bit. Haha. Better luck next time!

You seem to have ipo luck, always get something. Heard that grey market is at $1.10, with your well syndicated network did you also hear that ?????

I hope it is true so that the market can be boosted .

I have decided to stay away after reading your preview and review of Asia Pay TV.

Some of my friends went in for the ipo for the 8% yield. He put in one million shares by using his OD and was allotted more than 700 lots. He has the shocked of his life.

He is now waiting to dump as soon as the market is opened. I am not sure how many are in the same position.

Good luck to those who were allotted.

I always carry with me a sense of appreciation when I read your blog.

You are so generous to share your knowledge and wisdom to other investor.

I thank you for your very kind gesture.

Your sincere reader

Tks for the kind words. :)

The price has dropped below IPO price. Do you think it's a good idea to buy in some shares?

[[anonymous 7 ]]

hello CheyTan. Somehow I don't think you'd get a reply to your question anytime soon.

The comments have gone deathly silent. Suddenly.

All this is in the nature of markets.

LOL.

I decided to go in at 94 cents. I'll try to hang in for the first dividend, and decide from there.

Wish me luck =)

[[ anonymous 7 ]]

ps : I recall Religare HealthCare and Sabana REIT all diving soon after listing.

Religare Healthcare (RF1U.SI) is due for a dividend soon btw, ex div 04 June 2013.

We'd see who's left standing. All those newly enthusiastic about IPOs will soon not be so enthusiastic.

All in the nature of markets.

There is 1h:06mins to market close from now.

[[ anonymous 7 ]]

OK, market close. last done 92 cents. Range : High/Low $1 / 91.5 cents

On-market volume at 167,874,000 shares.

Look for stabilization announcement today, tomorrow and Friday. If underwriters exhaust the over allotment option by then, watch out on Monday.

[[ anonymous 7 ]]

May I post a slightly off-topic comment? The comment is off-topic because it pertains to Hong Kong IPO debut.

Langham is debuting today, and also far is around HK$4.60; subscription price HK$5. The ticker for Langham is 01270.HK

I think the 3 hotels in Langham will continue to hold my interest; but the backdrop of rising USA interest rates, and also the bird flu problem will have to be borne in mind.

There seems to be an all-Asia sell off in REITs, I think. Singapore is not immune.

[[ anonymous 7 ]]

re : Hope it is just May - sell n go phenomenon!

====================

... and what about the interest rates?

[[ anonymous 7 ]]

Anyway, regardless of what happens to interest rates, don't get carried away by "wealth effects".

If shares are going up because of lower interest rates, or just plain money printing, then recognise it for what it is.

This "wealth effect" is illusionary, but it always catches people out. All the time.

I'm keeping the dividends.

Whether passive income or not, dividends will just remain approximately passively unspent.

Just and deserved desserts in the age of money printing.

Look forward to your review of Tee Land

"Asian Pay Television Trust, owner of Taiwan’s third-largest cable television operator, slumped on its first day of trading in Singapore to become THE WORLD'S WORST INITIAL PUBLIC OFFERING this year on concern marginal earnings growth will limit its ability to sustain dividends."

http://www.businessweek.com/news/2013-05-29/asian-pay-television-declines-in-trading-debut-singapore-mover

[[ anonymous 7 ]]

Aiyah !!!! PLEASE!

This is businessweek you are talking about, or is it some american-style journalism. Which reporter wrote that; do they know what they are talking about?

Langham is HK$4.40 from initial price of HK$5, so how the (expletive!) can Asia Pay TV be the worst?

Lots of IPOs last year had worse starting performances.

Please don't get carried away with these ridiculous reports. Don't believe everything you read in this american media.

And, hype is double-edged sword.

Or, do you suggest the misinformed author was naively hopeful and bought some shares?

If APTT and its Sponsor is aggrieved by such coverage, let's see them complain and procure a retraction.

[[ anonymous 7 ]]

This has nothing to do with APTT Sponsors or the like.

I'm saying this sort of "THE WORLD'S WORST INITIAL PUBLIC OFFERING " garbage over-blown reporting.

For some unknown reason, some of these american reporters have taken to overdramatic reporting like :

The worst since last year

The worst since last week

The worst since last month

... etc etc

But when one actually looks at the graph and the data, it is really nothing as dramatic as that.

As for hype being a double edged sword, it may be, but that no relevance here.

The author of the piece has not entered my thoughts, and I don't really care what the author has or not not bought.

Irrelevant, and overly dramatic. Absurd reporting.

And before any body asks, or raises yet more irrelevant questions, no I did not obtain any APPT shares and I'm not trying to grumble about idiotic reporting that may affect any of my so-called "interests".

I'm pointing out that that american style reporting in whatever businessweek or similar is overblown, does not give the correct impression, and is to be ignored.

I guess one might even say that author must also be the "WORLD'S WORST REPORTER SINCE YESTERDAY".