THE turmoil engulfing the stock market has been dealing a huge blow to the once-thriving initial public offering (IPO) sector. The Straits Times THE turmoil engulfing the stock market has been dealing a huge blow to the once-thriving initial public offering (IPO) sector.

Investors who have been reaping windfalls from IPOs now have cold feet amid a hair-raising investment climate and are instead seeking safety in blue chips. Only one of the nine firms that listed on the Singapore Exchange this month - Ascendas India Trust - is still trading above its issue price. The rest have fallen between 6.25 per cent and 33 per cent below their issue prices.

This is in stark contrast to the first seven months of the year, when new listings regularly traded at a hefty premium over their IPO prices.

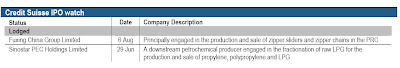

Dealers expect the flow of IPOs to peter out over the next two months. Only two preliminary IPO prospectuses have been posted on the Monetary Authority of Singapore's Opera website, while two have already been withdrawn. Companies are likely to delay listing because liquidity is drying up as the number of investors willing to take up placement shares dwindles.

'Some investors have become so used to the idea of getting a regular windfall from IPOs that they have forgotten that there may be a risk involved. The moment they lose some money, they also lose interest,' a dealer said.

The local bourse has been on a roller-coaster ride, as the crisis in the United States' mortgage sector continues to plague global financial markets. Despite the souring appetite for risk, a Singapore merchant banker noted that some firms had gone ahead with their IPOs here, as the accounts presented on their prospectuses 'might have gone stale otherwise'.

'By failing to hold back, these firms are taking a risk that their IPOs will be poorly received by the investing public, which is unnerved by events on Wall Street,' he said. There has also been a flight to quality, as investors switched out of riskier stocks into blue chips, which seem to be weathering the wild market swings better.

Phillip Securities managing director Loh Hoon Sun said: 'Most new listings are fairly small and do not attract an institutional crowd. So, it is not surprising to find retail investors losing interest in these companies when their prices fell.'

Bigger IPOs have generally fared better of late. Ascendas India Trust, which has a market value of $1.1 billion, was still up 18.6 per cent over its IPO price of $1.18 when it closed at $1.40 yesterday. Parkway Life Reit, with a market capitalisation of $721 million, was down just 6.25 per cent from its $1.28 issue price. It closed at $1.20 yesterday. But textile maker China Hongcheng has fallen 33 per cent to 33.5 cents from its 50 cent debut on Aug 8. Its market value is only $89.8 million. Another smallish IPO, Sunmart Holdings, which makes spray products and has a market value of $70.4 million, fared almost as badly. It has fallen 30 per cent from its 25 cent debut on Aug 15 to 17.5 cents. Some dealers do not expect IPOs to make a speedy comeback, given uncertainties in the market .

'There are already some cheap bargains available, as some stocks have fallen 50 per cent to 60 per cent from their peaks. Why should anyone bother about IPOs?' one dealer said.

Upcoming IPOs? Any takers?

Comments