Parkway Life REIT is established by Parkway Holdings to invest primarily in income-producing real estate and/or real-estate related assets in the Asia Pacific region that are used primarily for healthcare and/or healthcare related purposes. The initial portfolio includes Mount Elizabeth Hospital, Gleneagles Hospital and Eastshore Hospital. The prospectus is here.

Offering: 288,865,000 units at $1.28 per unit. (subject to overallotment).

Public offer closing date: 13 August 2007 12 pm

Listing date: 23 August 2007 2pm

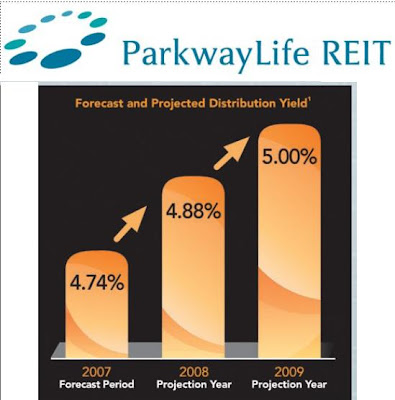

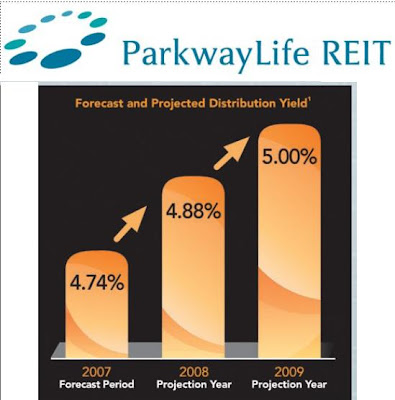

This is the 2nd "healthcare" reit after First Reit. Although the yield is lower than First Reit, it can be considered as a better quality Reit when compared to First Reit as it has 3 well-known hospitals that are located in Singapore (no political or forex risk) and is backed by a reputable sponsor (where Singapore is trying to be a medical hub). Unfortunately the yields from Parkway REIT is not 'spectacular' where it offers 4.74% in 2007, 4.88% in 2008 and 5% in 2009. It could, however, provide an alternative asset class to investors who wants to diversify their exposure from other types of property REITs.

Personally i believe Parkway REIT will be well received by the investors and assuming a yield compression to 4% on blended 2007/2008 yields, the fair value should be between $1.50 to $1.60 and that represent some 10-20% upside from its IPO price. In times of uncertainty, defensive stocks like Parkway REIT should still be well -received by the investing public, especially one from a reputable Sponsor with good properties.

Comments