Shopper360 Limited ("Shopper360" or the "Company") announced that is IPO attracted strong interest from institutional investors. There is no public offering (which is why it can't get the highest rating from me).

Ms Chew elaborated, "As a listed company, we are now in a better position to fortify our market position and stay ahead of the competition. The increasing importance for shopper engagement and experience, bolstered by a proliferation of brick-and-mortar retail stores, bode well for us, as the synergistic nature of our business segments enables us to provide integrated solutions to our customers at every touch point – from pre-store, in-store to post-store. We also have a strong pipeline to introduce new innovative mediums to our existing suite of services, and are well-placed to capture opportunities in the digital economy."

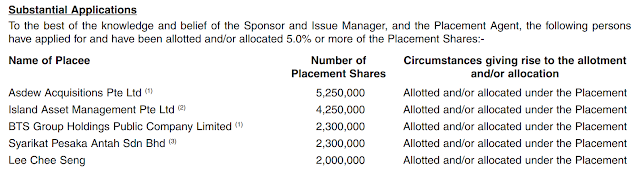

The shares were placed out to an interesting list of investors, including Asdew (Alan Wang),

Island Asset Management and

BTS Group. Interesting to see a Thai public listed company venturing into this space, hopefully it is for strategic reasons lol. I am sure many of you have taken BTS before while in Bangkok.

Good luck to those who managed to get some placement shares.

Happy shopping.

Comments