Sanli Environmental Limited ("Sanli" or the "Company") announced that it received overwhelming investor interest in its IPO. The key takeaways as follows:

- IPO was 12.8x subscribed

- Pre IPO investor, Heliconia Capital, increased its shareholding to 7.97% (A good sign)

- ICH Gemini Asia Growth and Jeremy Lee Seng Poh subscribed for 17.2 placement shares

"Commenting on the robust support for Sanli's IPO, Mr Sim Hock Heng, CEO of Sanli, said, "We are encouraged by the overwhelming support we have received from our institutional investors, including our anchor investors, and the investing public. This is testament to investors' faith in Sanli's robust track record and the bright prospects of the water industry. We look forward to bringing Sanli to its next level of growth with our new status as a listed company, and we are glad to have the investing public join us in this new chapter of our growth story."

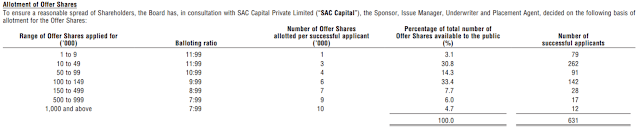

The balloting table is below:

It is good to see that the Company or Manager has give small investors (those apply 1 to 99,000 shares) a higher balloting ratio than those who applied for 100,000 shares or more. Please keep it up!

The placement tranche also see Heliconia (a Temasek related company) increasing its stake as well as fund manager (ICH) and prominent investor (Jeremy Lee) participating in this IPO.

I would expect this IPO to debut very well tomorrow! Huat ah! Congrats to those who managed to get the shares from the ATM!

Comments

If it is an artificial beauty, then the offer price is a bit pricey.

nonetheless, IPO debut should perform well.