The Singapore IPO market continues to be buoyant in the first eight months where we witnessed an exciting "fight" between SPH REIT and OUE Hospitality Trust. Unfortunately, the Singapore IPO scene has been far dominated by the listings of mainly REITs and Business Trusts. Good companies trying to list here have been few and far in between, with only a handful of oil & gas companies such as KrisEnergy and Rex International, trying their best to light up the local IPO market. With the market currently in doldrums, it will be a challenge to see any strong pipeline of IPOs in the coming few months.

Let's now do a recap on the companies trying to IPO in the Singapore market for the first 8 months of 2013 and dig deeper into the trends to find out whether investors managed to profit from these IPOs.

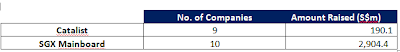

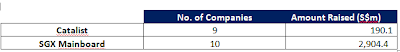

As of 31 Aug 2013, there had been 19 IPOs in Singapore of which it was almost evenly split between companies listing on the SGX mainboard and those listing on Catalist. Catalist continues to attract smaller companies with short track records but this is also reflected by the small amount of money raised of approximately $190m.

SGX Main Board

SGX Main Board

Let's take a more in-depth analysis into the companies that was listed on SGX Main Board.

As you can see, SGX continues to be a strong magnet for REITs and Business Trust listings in the region! Asian Pay TV Trust, Croesus Retail Trust and OUE Hospitality Trust raised a total of $1.18b while Mapletree Greater China Commercial Trust, SPH REIT and Soilbuild Business REIT raised a total of $1.4b! In my view, I think investors' fatigue are setting in for such listings and it will be a challenge to see a mega REIT or Business Trust listing in the near term.

Performance of Main Board Companies post- IPO

Let's do a more in-depth analysis on how the main board IPO listings performed and whether investors are better off selling off the stocks on the first week of its listing or holding it till 31 August 2013.

The table above shows the performance of the 10 main board IPO companies listed this year. Green colour indicates that is above IPO price while the orange colour indicates that it is below IPO price.

As you can see from the table above, 7 counters were above water at the end of the first week but that number dropped drastically to 3 if you extend the period till end Aug 2013. It somewhat shows that investors of IPOs this year are better off selling them at the end of first week of listing rather than to hold on to them. The data showed that 7 out of 10 mainboard IPO companies are in the 'red' as of 31 Aug 2013 and only one company, Overseas Education Ltd, managed to see its share price appreciate by more than 50% since listing.

You can find the detailed graphical performance of these 10 main board companies below.

Catalist

Catalist

Let's do a similar analysis for companies listing on Catalist. In case you don't know, I do have a natural dislike for small caps listing on Catalist but once again, I have been proven wrong by my own findings by the share price performance of these Catalist listings post IPO.

The table above showed that after one week of listing, 6 out of companies listing on Catalist are in the green and as of 31 Aug 2013, the statistic remained the same. In fact, the table also showed that the share price increase of small caps has outperformed the IPO companies on mainboard. An amazing 4 out of 9 companies have seen their share price increases by more than 50%! Investors who hold on to these Catalist companies post listing are definitely better off than selling them on the first week.

The graphical view on the share price performance of these Catalist companies.

Conclusion

Conclusion

The analysis above proves to be humbling as the Catalist listings have proven to outperform the main board listings. For me personally, I have to learn to be less discriminating towards Catalist listings and have more confidence in them.

However having said that, under the current market practices, most retail investors like you and I will have little or no chance of getting any shares if the manager opt to have only a placement tranche and no public tranche. Investors who are keen to invest in small cap Catalist stocks will have to buy from the market post listing and that requires another leap of faith as well.

Are you ready to take the leap and support our Catalist IPO market?

Comments