The Assembly Place - Balloting Results

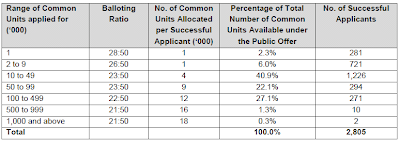

This is probably one of the most usual press releases that went alongside the SGX announcement of the balloting results. The Company released a full presentation deck , which is actually quite informative, with information of upcoming pipeline etc (probably the Company felt that it is safer to release this after the IPO closes and not before). The balloting table is as follows: The IPO has drawn strong interest from prominent institutional funds such as Avanda Investment Management (as investment manager for and on behalf of its fund(s)) and Lion Global Investors Limited (as investment manager for and on behalf of its clients), along with prominent investors, including Mr Han Seng Juan, Mr Rudolf Jurgen August Rolles and Mr Chong Soon Kong @ Chi Suim2 , underscoring strong confidence in TAP's investment proposition. Separate from the Invitation, cornerstone investors, namely Apricot Capital Pte. Ltd., Asdew Acquisitions Pte. Ltd., Cache Capital Pte. Ltd., ICH Synergrowth Fun...

Comments

thanks for all your comments thus far, I am sure we all earned $$$$ from it.

you were spot on with Reglare which listed at 0.90, ipo opening price 0.89 then now 0.80, those who got it suay man

but GEO ENERGY, OMG! you would have earned 65% if you sold at 0.49, you could at least earn 50%....

i think my larger point is sentiment for IPO is actually quite good given the long hiatus of lack of ipo, there is a pent-up funds and interest in IPO, even weak counters are doing well....

im gg for gaylin, my only worry is that there are too many counters, people funds spread too thin.