Religare Health Trust announced

two things:

Listing date will be brought forward from 9am on 22 Oct 2012 9 am to 2pm on 19 Oct 2012 (today). Not sure which Fengshui Master advised them to change the date and time for an auspicious start but we shall see if it works. :P My other guess is that they probably want to confuse the sellers who may want to sell on the first day.

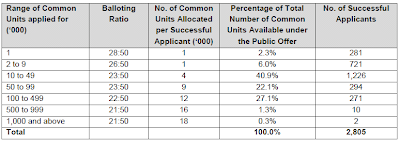

Balloting results for the public tranche:

The public tranche was 14.5x subscribed and investors will have around 50% chance. They have skewed the distribution to investors who apply for less shares this time.

Placement Tranche

It is interesting to note that Henderson Global Investors was allocated 30m shares but was only mentioned in a "small paragraph" while Temasek who subscribed for only 15m shares were given a "nice placeholder"? Probably they want to make sure the "Temasek" name is well publicized but don't read too much into it as such stakes are probably too small for Mr. T.

Happy IPOing.

Comments

thanks for all your comments thus far, I am sure we all earned $$$$ from it.

you were spot on with Reglare which listed at 0.90, ipo opening price 0.89 then now 0.80, those who got it suay man

but GEO ENERGY, OMG! you would have earned 65% if you sold at 0.49, you could at least earn 50%....

i think my larger point is sentiment for IPO is actually quite good given the long hiatus of lack of ipo, there is a pent-up funds and interest in IPO, even weak counters are doing well....

im gg for gaylin, my only worry is that there are too many counters, people funds spread too thin.