- SGD 260 million Class A-1 @ 4.35% (5 years)

- USD 50 million Class A-2 @ 6.35% (6 years)

Application for the bonds will close on 17 July 2024 at 12 noon

What are Astrea PE Bonds?

Astrea is a bond programme where each series of bonds are backed by cash flows from a unique portfolio of PE funds. Astrea 8 is the latest series of PE bonds by Azalea. Given the history of my blog, I have covered all the issuances in the past and you can find the links below:

I have decided not to go through the details of the portfolio and how it works given I have written so many prior write ups. You should read the gatefold and watch the management presentation available online. In the event you just want to meet the team behind the bonds, you can also sign up for the meet the people session taking place

next Monday evening (I saw it in the advertisements today).

In a nutshell, the portfolio is well diversified with more than 1,000 companies and the cash flow generated from the divestment of these 1,000 companies over time are more than enough to pay bondholders interest and for the eventual principal redemption. Based on prior Astreas, there is always enough cash flow generated from the portfolios. Sounds simple enough? 🤪

What are the key differences between Astrea 7 and Astrea 8?

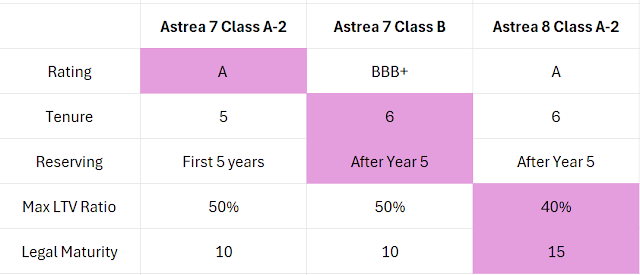

Both Astrea 7 and Astrea 8 featured a SGD and a USD tranche. The SGD tranche seemed similar in both Astrea 7 and Astrea 8 but the Class A-2 and Class B that were featured in Astrea 7 have now been "combined" into one tranche. In other words, the Class A-2 tranche in Astrea 8 took on some of the features of Astrea 7 Class A-2 and some from Astrea 7 Class B.

In the table below, the highlighted column indicates where it is similar between A7 and A8. If it appears under the Astrea 8 column, then it is a new feature.

The key changes in Astrea 8 is the lowering of Max LTV ratio from 50% to 40% (which is even more protective to bond holders) while extending the legal maturity from 10 years to 15 years. My guess is that the last two changes (40% Max LTV and 15 years legal maturity) were made to allow the bonds to receive an A rating, and the benefit will be a lower interest rate for the Issuer.

There is also a new feature where the cash in the reserves accounts can be substituted by a bankers guarantee rated AA and above. I am "neutral" on this feature as cash in the reserves account would have been placed in bank deposits or worse still, other rated corporate bonds anyway.

How had prior issuance of bonds performed?

As shown in the table below, all the bonds issued in Astrea III and Astrea IV have been fully redeemed. In addition, the Class A bonds in Astrea V have also been redeemed in June 2024. You can see from the table below that the reserves of Astrea VI and Astrea 7 are on track as well. Given the prior Astreas have shown a strong track record of redeeming the bonds on time (at the 5 year mark), I am pretty comfortable that Astrea 8 will be no exception.

Are the interest rates of Class A-1 and Class A-2 attractive?

As in all prior issuances, the bonds went through an institutional book building process where professional investors like Endowment, Asset Managers, Pensions, Insurance set the pricing. From the press release, it looks like the placement tranche attracted strong demand from high quality institutions, with an orderbook in excess of S$1.2 billion, representing 2.6x subscription.

While some may argue that Temasek doesn't guarantee the bonds and Astrea takes on the form of an ABS (asset backed securities), I would still regard Astrea as a high quality issuance considering that most local bonds are not even rated and may not even have the same track record of repayment. So what are the alternatives for retail investors?

For the SGD tranche, fixed deposit rates for 3 to 12 months are between 2.5% to 3.5% and Temasek linked corporate bonds with a tenure of 4-5 years are trading below 4%. As such, at 4.35% locked in for five years is not too bad.

For the USD tranche, the weekly to monthly fixed deposit interest rates are between 4.6% to 5.2%. At 6.35%, the pick up yield of more than 1% and locking in for 6 years may not be a bad idea. Having said that, investors should be mindful of the USD exposure and currency conversion risks.

Should I Invest in the bonds?

My view is this, if you are younger than 35 years old and have a lot of cash needs, it might make sense to invest in something with potential for higher returns or better liquidity. After all, this is only a debt instrument.

If you are risk averse, if you want to diversify out from your riskier assets, if you are close to retirement, then allocating bonds to your overall portfolio makes total sense to me. I have used bonds to create an income ladder for myself and you can do it as well. For investors who have received their cash back from Astrea V, maybe it is a good idea to re-invest into the bonds if you don't have any cash needs.

What strategy should I use to apply for the bonds

My gut feel is that the both classes of Astrea 8 bonds will be very hot this time. The Class A-1 bonds of S$260m should be easily subscribed by 3x to 5x. The Class A-2 USD tranche this time round is half the size of Astrea 7 Class B. With the US interest rate expected to come down, many institutional investors have been positioning themselves to lock in the rates now. Retail investors with excess cash needs can consider doing the same and I expect the USD tranche to be subscribed by 2x to 3x.

For investors who want to "bao jiak", you may want to apply $49,000.

For investors who prefer a larger allocation, you may want to apply as much as possible as historically, you have a 50% chance of being allocated some shares. Please remember to wear red undies when you apply. 😆

Conclusion

Astrea 8 PE Class A bonds are suitable for investors who meet one or more of the following criteria:

- Risk averse / Lower risk profile

- Have spare cash with no near term needs or flooded with cash

- Don't know how to invest or where to invest

- Would like to lock in the interest rates for the longer term before it drops

- Investors looking for steady cash flow yield

While this is not an equity IPO, I will give it a 3 chilli rating given this is one of the rare bond issuance that are of investment grade and a decent yield.

Please note that my views are biased as I received a small allocation from my RM. I understand that the placement tranche was pretty hot and there weren't enough to go around...

Now should I tikam for the IPO or not? 🤔

Comments