Econ Healthcare ("Econ" or the "Company") announced that its public offering of 1.8m shares was 86.9x subscribed. Including the 48.2m placement shares, the offering was around 4.1x subscribed.

Mr Ong Chu Poh (王再保), founder, Executive Chairman and Group Chief Executive

Officer of Econ Healthcare, said: "We are highly encouraged by the response we have

garnered for our IPO, which is indicative of the investing public's recognition of Econ

Healthcare's growth potential. We believe that our established track record of 30 years of

experience in senior care, as well as our resilient business model, will enhance the

Group's market position in the industry as we scale and expand our service offerings."

"We are committed to serve the senior community, and bring the best of care and service

to families and communities in the region. I am confident that we are in a good position

to capture the growth opportunities that exist with the growing ageing population in

Singapore, Malaysia and China," added Mr Ong.

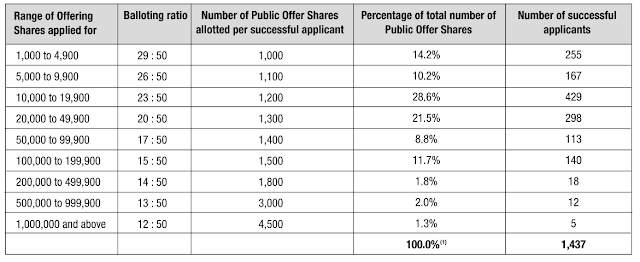

The balloting table is below for your reference.

Looking at the balloting table, I believe investors who applied for the IPO will be very upset and rightly so! Investors who are not allotted should feel very lucky instead.

The Company has basically made it difficult for public investors to sell their shares. Imagine you applied for 100,000 shares and you were allotted 1,500 shares. You can't even flip the shares at 30c as you can't cover your brokerage fees. Personally I think the Company should not have adopted this allocation strategy and irritate the investors. It should have allocated a more meaningful sum even if it means a lower probability of getting those shares via balloting.

The Company also didn't announce any institutional investors coming in for this offering, which doesn't bode well for post-IPO market support as well.

Let's see how it performs on Monday...

Comments

Thanks for sharing so much knowledge!

As I know normally the cost for selling stock minimum is S$25. The application cost is S$2. I am curious for these who are allocated with 1000 shares at price S$0.2+. Need stock price going up 10% to cover the cost?

Or is there any way to sell it with a low cost? could you recommend please?