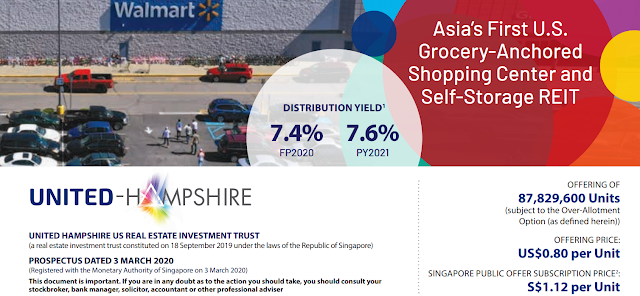

United Hampshire US REIT ("UH REIT" or the "REIT") is offering 87,829,600 units at US$0.80 per unit. 80,329,600 units are via placement with only 7.5m units available to the retail investors. If you apply through the ATM, the subscription exchange rate has already been fixed at S$1.12. The market cap based on the IPO price is US$614.2 million.

The IPO will close on 10 March 2020 at 12pm and start trading on 12 March 2020 at 2pm.

About the mall industry in the US

The retail industry in US has gone through much duress. Many US retailers have either went bust or needed to reinvent themselves from the onslaught of Amazon and the changing habits of its consumers. The reason why Amazon was so successful was because it offered consumers choices and speedy delivery. As such, many pure brick and mortar retailers have gone out of businesses. The empty space left vacant have now been taken over by "stores with experiences" such as dining or fitness centers. Personally, i don't think the tenant composition is by design, it is how the market in US has evolved. If the properties had not been re-designed, the malls will be empty!

How the REIT is positioning itself

The REIT is touted as "Asia's First US grocery-anchored shopping center and self-storage" REIT. According to the prospectus, the tenants targeted by UH are resilient to the impact of e-commerce such as restaurants, home improvements stores, fitness centers and warehouse clubs. The Issuer spent much effort to tell you that its portfolio sector is "least affected" by e-commerce (i.e. Amazon).

Portfolio

You can see that the properties are located on the East Coast. There are 18 Grocery & Necessity and 4 Self Storage centers. The appraised value is around US$599.2 million with 95.2% occupancy rate. 97% of the assets are freehold.

Key Investment Highlights

Key Financials

UH REIT has built in escalation and no break clauses. This provided some comfort that the income will be sustained, at least for the next few years.

Distribution Yield

The first distribution will be for the period from Listing till 30 June 2020, on or before 30 Sep 2020.

As you can see from the chart above, the interest rate for FY2020 and FY2021 will be 7.4% and 7.6% respectively. The top up arrangements allow time for some of the assets to “stabilize”.

Shareholders list

You can see from the shareholders list below that the Cornerstone investors took up 60.8% of the issuance. This issuance is very “hot” among the ultra high net worths and some institutional investors. According to the Edge article, the placement tranche is >3x subscribed. The public offering comprise only 20.8% (assuming over-allotment is exercised).

What I like about the REIT

- Stable cash flow from long leases - The REIT has WALE of 8.4 years based on Base Rental Income. Around 60% of the leases expires beyond 2025. This means the rental income is pretty stable for the foreseeable future

- Top tenants base - You can see from the list below that the top 10 tenants include BJ Wholesale, Ahold, Lowe's, Walmart, LA Fitness and Home Depot.

- Known local sponsor - UOB has acted as co-investor and provided seed capital. The Manager is also 50:50 held by UOB Global Capital and Hampshire. The presence of a local and known sponsor would provide some comfort to investors as UOB would not want to have any repercussions to tarnish its UOB branding.

- First distribution is not too far away - At least the first distribution period is in Q3 2020. You don’t have to wait for too long!

- Yield cut in the US - The US treasury cuts it yield by 50 bps when the IPO offering was underway. This will probably provide another boost to REITs, especially those denominated in the US.

Some of my concerns

- Complicated top up arrangements - The REIT has entered into some top up and earn-out arrangements using the IPO proceeds. As you can see from above, without the top up, the yield for 2020 would have been 6.4% instead of 7.4%. While the intent may be good, i personally dislike such arrangements as it doesn’t reflect the true picture

- Premium over NAV - Investors are paying a price to book of 1.07x. Given that such assets are not “sought” after, investors are probably paying a fair value for these assets.

- USD exposure - Investors should be aware that they are taking on USD exposure, hence the income for local investors will fluctuate along with the forex rates

- COVID 19 - the virus is taking a toll globally and will likely impact the retail sector in the US as well, with most investors likely to go out to the malls less. There is no certainty when this will blow over but if it drags on, it may impact some of the tenants at the mall

Conclusion

As in all REITs, this is not for short term speculation. Invest only if you like the “grocery-mall” sector and the yield. I will give it a 1.5 Chilli for the reasons above.

Happy grocery shopping in the US!

Comments

Just wondering if you have any further insights to the income top up arrangement? I read in the prospectus that c.6 mil will be set aside from IPO proceeds to fund the rental support. I'm wondering if this is akin to paying investors with their own equity? Curious as to whether this is a common arrangement or are you aware of previous IPOs with this type of rental support?

Thank you!

I am looking to buy existing stocks so will likely give this a miss.

I personally don’t like it but this type of arrangement (ie setting ipo proceeds aside) is pretty unusual. Don’t have further insights other than from the prospectus.