Elite Commercial REIT ("Elite" or the "REIT") announced that its public offer was 8.3x subscribed.

The placement tranche of 108,951,900 units were 3.2x subscribed.

Ms. Shaldine Wang (黄晓亭), Chief Executive Officer of the Manager, said, "We are delighted with the overwhelming response and support from Cornerstone, Institutional and retail investors to our Offering. This is a testament of our strong investment proposition of providing investors with attractive yields and steady cash flow, backed by our stable IPO Portfolio leased to the AA-rated UK Government."

"Going forward, we will focus on harnessing the REIT's growth potential from acquisition, enhancement and redevelopment opportunities to generate sustainable long-term distribution growth for our Unitholders. In particular, we have a right of first refusal granted by Elite UK Commercial Fund II, a private trust managed by our Sponsor – Elite Partners Holdings Pte. Ltd., which comprises of 62 commercial properties located across the UK, which are primarily long-term leased to the UK Government," she added.

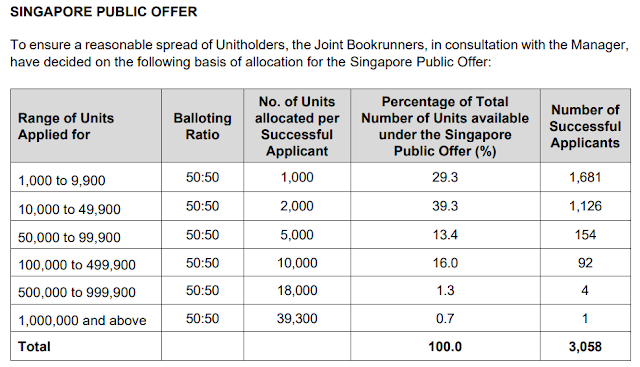

For those who applied, you would have a 100% chance of being allotted, and the balloting table is presented above for your information.

Overall, i think it is a good outcome for the Issuer. The size and the public offer wasn't too big and was able to attract and absorb all the demand among the corona virus situation.

Good luck to those who applied!

Comments