The Trust's principal objective is to deliver regular and stable distributions to investors and achieve long term growth in DPS and NAV, while maintaining an appropriate capital structure.

First pure-play US Hospitality Trust

ARAHT is the first pure-play US upscale select-service hospitality trust to be listed on SGX. The portfolio comprise 38 upscale select-service hotels located in 21 states with 36 out of 38 freehold properties. All the properties are franchised under the Hyatt Place and Hyatt House brands.

The Trust intends to proactively manage the properties to achieve growth in net property income, maintain optimal occupancy rate and source hotel properties that fit with its investment strategy.

Sponsor

The Sponsor is indirect wholly owned subsidiary of ARA Asset Management Limited, headquartered in Singapore but more "known" as the manager of Suntec REIT, and manages 5 other listed REITs. The Sponsor will subscribe for 53.75m Units.

Cornerstone investors

The Cornerstone investors has agreed to subscribe to 132.382m units and include Gordon and Celine Tang (of Singhaiyi) and the private banks such as Bank of Singapore, Credit Suisse.

Initial Portfolio

The initial portfolio comprises 27 Hyatt Place Hotels and 11 Hyatt House hotels, with 4,950

rooms and appraised value of US$719.5m.

From the picture above, you can see that the portfolio is spread throughout USA but with more on the Northeast and Southern side (76% of the portfolio value).

Hyatt Place - upscale select service hotels.

Hyatt House - upscale extended stay hotels.

Structure chart

The structure chart is included above for your ease of reference.

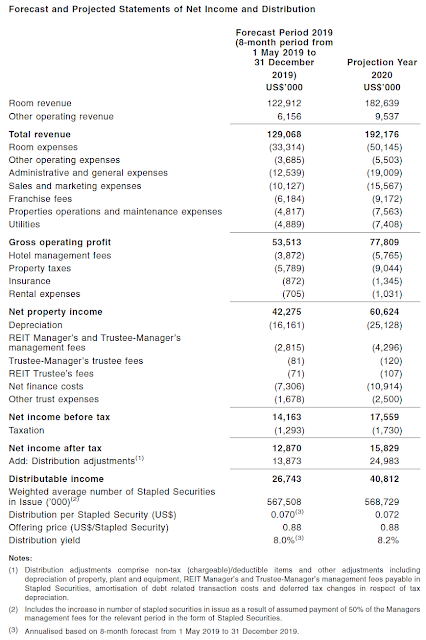

Projection Distribution

Based on the above forecasts, the annualised yield for the period from listing till 31 Dec 2019 is around 8% and 8.2% for year ending Dec 2020. There is seasonality in the revenue generated where first and last quarters are quieter than the second and third quarters (April to Sep).

The occupancy for the last 3 years was around 77-79%. Average daily rate was US$122. The revenue seemed to be pretty stable, giving some comfort on the recurring nature of the revenue stream.

Distribution Dates

The distributions will be made on semi-annual basis and the first distribution date for the period from listing date till 31 Dec 2019 will be paid by the Manager on or before 31 March 2020.

What I like about ARAHT

•

First pure play hospitality portfolio of brand and quality, from reputable sponsor and experienced Operator - The REIT segment on SGX is probably the last few sectors that are still able to attract quality listing and I am glad to see a more quality listing. The Hyatt brand managed by Aimbridge as well as a reputable sponsor in ARA bodes well for this listing.

• Positive US macroeconomic outlook - relative to the economic outlook globally, US macro remained positive and that will bode well for the hospitality sector. The US real GDP growth is expected to continue at a CAGR of 2% from 2019 to 2023.

• Freehold properties acquired at "fair" value - Freehold properties are able to preserve value better and acts as good inflation hedge but investors are getting only a "fair" deal as the NAV per unit of 86 US cents is slightly below its IPO price of US 88 cents. The implied price-to-book is around 1.02x.

• Prudent capital structure - The aggregate leverage is around 36%, indicating the balance sheet is not too overly geared and there is headroom for adding on debt for new acquisitions. The limit permitted is around 124% (page 124 of prospectus)

• Reasonable remuneration package - the executive officers seemed to be reasonably paid (page 311). All will receive a remuneration less than S$250,000.

Some of my concerns

• US Tax rules can be fickle and unpredictable - not too long back, the two US REITs listed here were sold down due to uncertainties over the tax impact from withholding. US has always been an onerous tax regime, especially those relating to income derived from real properties such as FIRPTA etc are always a big concern for overseas investors. This is something uncontrollable that may hit investors at anytime. To enjoy this tax status, one of the current requirement is that no one can own >9.8% of the Trust (Gordan and Celine Tang holds 9.5%). The prospectus also highlighted many tax related "risks" in its risk disclosure.

• Hospitality assets always require "upgrading" - Similar to hotels, such assets require a fresh face lift from time to time termed under "asset enhancement". Such activities will require capital outlay that is needed to be set aside from its operating and distributable income from time to time. The projected capex is around US$18.7m for the next 20 months (page 264)

• Still a long way to first distribution - given this is the IPO, investors will have to wait for 6-9 months before getting the first payout. Investors who are less patient (or concern about time value of money) may want to consider other US REITs that are already in steady distribution mode or buy this counter from the open market nearer to its first payout. Example - if you buy Keppel KBS Reit now, the wait is shorter to the first payout and consequently the implied yield is higher.

• Nature of Hospitality Assets - the nature of hospitality assets are the "room

nights" are perishable assets and the hotel revenue are less predictable than longer term residential or commercial leases. It can also be impacted by unforeseen circumstances (e.g bad hurricanes or terrorist attacks on USA impacting travel demand). The mitigating factors are diversified portfolio, stable consistent revenue generated over last 3 years. Theoretically, investors should "demand" a higher yield than other types of assets.

Fair value

How do i value ARA Hospitality Trust? I will look at it from two angles - one comparison against will be against other hospitality trusts and the other comparison will be against US REITs listed here.

Due to differential in base interest rate between SGD and USD, i would regard the rate presented by Manulife and Keppel KBS REIT as more reflective of the expected USD dividend rate required by investors. I have also taken the DPU from DBS research reports for that two counters. Manulife has better quality assets and more rental predictability, hence it has a lower implied yield than compared to Keppel KBS and ARA US Hospitality REIT.

I would regard ARA US Hospitality Trust as fairly valued but they left some room for capital appreciation post IPO.

Based on the implied yield of 7.5%-8%, the trading range will be between 88 to 94 cents. Based on the price to book of 0.95x to 1.02x, the fair value range will be 84 to 88 cents. I would expect the share price to trade between 85 to 95 cents. My own anyhow guess is that it will debut at between 88-90 cents.

Mr IPO Chilli Ratings

2 🌶

Please note that this IPO is not for punting and the chilli ratings reflect the longer term value for investors. I like the 8% dividend yield and relatively conservative leverage ratio but investors will have to be comfortable with the USD forex exposure.

As the timing to the first payout date is more than 9 months away, my own view is that investors could potentially be better off investing in Keppel KBS US Reit as the time to next distribution is closer with about the same yield and better predictability.

Since i am already heavily exposed to USD distributions inflows, i will likely give it a miss. However for investors who favors the hospitality sector, this IPO qualifies as one with a good brand name and sponsor. Having said that, i have to admit that i have never stayed in those hotels before.

Polling Time!

You can take the poll

here.

Comments