Eagle Hospitality Trust ("EHT" or the "Trust") is offering 580,558,000 Stapled Securities at 78 US cents, of which 44,871,000 units will be via the Public Offer with the balance already distributed through the Placement Tranche. Investors applying through the ATM will be paying based on the exchange rate of USD/SGD of S$1.3731. The IPO will close on 22 May at 12 noon and start trading at 2pm on 24 May.

Principal Business

EHT is established to invest in income producing real estate used primarily for hospitality-related purposes with initial focus in the United States.

Key Investment Highlights

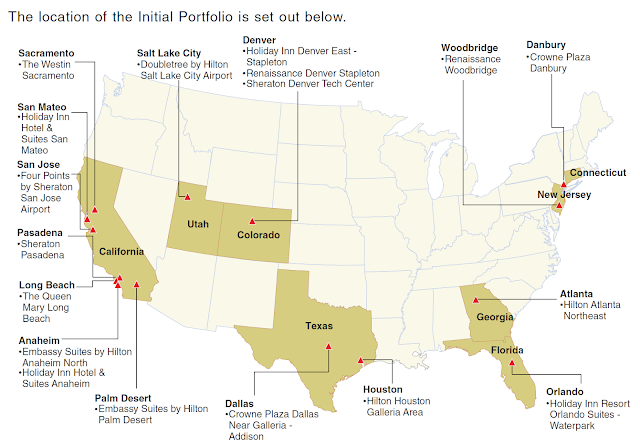

Initial Portfolio

The initial portfolio comprise 18 full service hotel properties in the mid to upper upscale hotels. There are 5,420 rooms with a value of US$1.27 billion. The average daily room rate for the Forecast Period and Projection Year is around US$137-$144.

Key Financial Highlights

Dividend Yield

The yield for the forecast period is 8.2% and projected to increase to 8.4% in Year 2020 (1 Jan 2020 to 31 Dec 2020). The distribution will be paid semi-annually, with the first distribution period from listing date till 31 Dec 2019 and the first payout in Q1 2020.

What I like about EHT

- Freehold properties linked to major hotel brands - The portfolio is freehold and diversified across different global hotel chains. 94% of the rooms are associated with Marriott, Hilton and IHG

- Strong US Macros and hospitality fundamentals - Baring any Global Financial Crisis, the US economy likely to stay stable and resilient in the next few years. The USD outlook is also favourable. Investors who subscribe at the ATM will get in at a "slightly better" rate should the current USDSGD rate holds up.

- Sponsor has skin in the game and has established a track record of building up the Initial Portfolio - The Sponsor rolled over 100% of its equity and the current portfolio is "evidence" of its own track record. If you look at the financials on page 65, the revenue has also increased steadily from FY2016 to FY2018.

Some of my concerns

- Sponsor is new - The Sponsor is new to the local market and owned by two individuals, Howard Wu and Taylor Woods. They are based in Los Angeles. The mitigant is that the Sponsor is not "cashing out" at the IPO but will retain a 15.2% stake in EHT. This will however, drop to 10.9% if the over-allotment is exercised

- US Taxation Rules and USD exposure - The US taxation rules on real estate has always been a concern, so investors will have to deal with this by making sure that they are not US Persons and submit all the necessary documents to enjoy a lower tax rate. In addition, investors must be comfortable with the USD exposure although it looked rosy currently. Personally i have no concern with such exposure as it is a form of diversification for me.

- Recurring income for hospitality assets can be unpredictable - Unlike office or retail malls, hospitality assets are more cyclical and not "long term" in nature, hence the daily rooms are considered 'perishable' assets. It is also highly dependent on the state of economy, whether it is consumer spending or business travel. As such, investors demand a higher yield for such assets.

Peer Comparison

Note: I have edited the Manulife US REIT and Keppel KBS Reit to follow that from Capital IQ to be consistent with the rest.

EHT is issued at a metrics that is favorable vis-a-vis its peers

Chilli Ratings

Once again, the chilli ratings (for short term flip) does not apply. This is not intended for a short term flip. Buy only if you like this asset class as well as the projected yield of 8.2%. I think the yield is attractive enough but the weak performances of US related REITs and the IPO market means that there could be a chance that investors can buy at a cheaper price post listing.

This is the second US hospitality trust right after ARA US Hospitality Trust. EHT offers a slightly higher yield and the portfolio that is diversified by different global hotel brands seemed a tad better. The seasonality of the revenue also seemed more stable. I also like the fact that the Sponsor has skin in the game. Thus between the two, EHT will get my vote if i have to choose between the two.

I will give it the same 2 Chilli Ratings for the reasons above. As for myself, i will not subscribe as i already have a significant amount of USD exposure.

Polling Time

You can vote

here.

Comments