For the IPO newbies, i have previously written a few articles that may still be relevant and for your benefit, i am posting the links here.

Question 1: Must you physically be in Singapore when you apply for the IPO shares?

Answer: UNLESS PERMISSIBLE IN SUCH OTHER JURISDICTION, YOU MUST BE IN SINGAPORE AT THE TIME OF THE MAKING OF THE APPLICATION FOR THE OFFERING SHARES.

The answer is yes, you have to be in Singapore! It was printed in BOLD and Capital Letters, indicating that this is an important point! In other words, it is illegal to apply for the shares through the internet banking if you are physically in United States at the point of application... feeling guilty now? 🈲

Question 2: What is the minimum number of shares you can subscribe for and in what multiples? Example, can you apply for 2,000 shares, or 2400 shares or 2,688 shares?

Answer: The minimum initial subscription is for 1,000 Offering Shares. You may subscribe for or

purchase a larger number of Offering Shares in integral multiples of 100. Your application for

any other number of Offering Shares will be rejected.

In other words, the rules are: (1) you must first apply at least 1,000 shares and (2) it must be in multiple of 100. Based on the question above, if you apply for 2,688 shares, it will be rejected but if you apply for 2,000 or 2,400 shares, it will be accepted.

Question 3: Can you apply for the same IPO placement shares with different banks or brokers? Example - Applying for Netlink Trust placement tranche through DBS, Credit Suisse and UOB?

Answer: Multiple applications may be made in the case of applications by any person for the

Placement Shares only (by way of Application Forms for Placement Shares or such other form of application as the Sole Issue Manager, Bookrunner and Underwriter may in its absolute discretion deem appropriate)

In other words, you can apply for Netlink placement shares through different banks or brokers

Question 4: Can you apply for the same IPO under both placement and public tranche?

Answer: Multiple applications may be made in the case of applications by any person for the Placement Shares together with a single application for the Public Offer Shares whether by way of an Application Form for Public Offer Shares or an Electronic Application.

In other words, you can apply for the placement tranche multiple times but you can only the public tranche once

Question 5: Can you apply for the same IPO public tranche using ATMs from different banks?

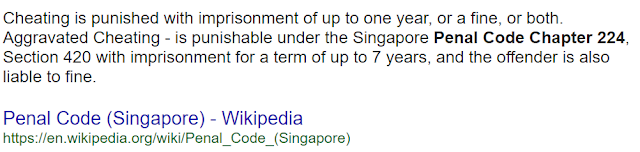

Answer: Only one application (be it using physical form or electronically) may be made for the benefit of one person for the Public Offer Shares in his own name. Multiple applications for the Public Offer Shares will be rejected. Persons submitting multiple applications for the Public Offer Shares may be deemed to have committed an offence under the Penal Code, Chapter 224 of Singapore, and the SFA, and such applications may be referred to the relevant authorities for investigation.

In other words, you can only make ONE application for the public tranche 🏧 and it is a serious offence and you can be charged in court for this. 👮

Question 6: Why can't i use the ATM network or Internet Banking platform of certain banks for some IPOs (the answer is not found in the Appendix F) 😋

This is an additional question which i have added which i think some people may not know.

ATMs

Usually the issuer will have to decide which banking network they would want to use to distribute the shares during the IPO application. The de facto bank will be DBS bank. DBS has the widest ATM network compared to the other 2 local banks. If the issuer decides that DBS is adequate, it may not extend the ATMs to UOB or OCBC, especially for smaller issuance.

in addition, some banks has internal restrictions. I understand UOB has certain restrictions internally on distributing perpetuals through its ATM network.

Internet Banking

DBS has the most advanced Internet banking and mobile app platform among the three banks. As such, DBS users can apply for IPO using both internet banking or mobile app platform. I have been using the DBS internet banking to apply for shares for the longest time. At the time of writing, the UOB and OCBC internet platform is still not ready for IPO applications. Do let me know if my understanding is wrong.

Polling time: Link is here

Comments

OCBC is a definite yes. Did my MUST application there and got it.

UOB is a vague yes. Remember i did it but don't remember which counter.

Same system right?

Ps: a complete noob here

In LY corporation case, first of all, you need to have an account with UOBKH. Secondly, you need to know the person by the name of A who is allocating the book. If you don't know this person A, then even if you have a UOBKH account is useless. Hope that explains