I received at least 10 private messages asking if i will be covering the ETF. Even though i don't really consider this an IPO, i will share my thoughts with you.

What is an Exchange Traded Fund ("ETF")?

A short while ago, ETF was not accessible to retail investors until

MAS relaxes that in April 2015! If you ask me what an ETF is, it is basically a fund tracking a particular index which it is set up for. In this particular case, this ETF is set up to track the Morningstar Singapore REIT Yield Focus Index.

Key information

The minimum application amount is 50,000 units (or $50,000) and it will be listed on 30 October 2017. The Managers are Lion Global Investors Limited and Phillip Capital Management. The Manager intends to pay out dividends semi-annually and you can find more information about the ETF

here. You can find the FAQs

here.

Who is ETF suitable for?

Investors who want regular distribution and seeking an "index-based" approach towards investing in a diversified basket of Singapore REITs listed on SGX. According to the prospectus, the ETF will not be actively managed as the Manager do not intend to actively select the REITs to outperform the market or take defensive positions in declining markets.

What i like about the ETF

- Low cost way for investors to start planning for their retirement. While the initial minimum subscription is $50,000, investors with less capital can subsequently buy and sell in smaller units once the ETF is listed

- Diversification. Investors are able to gain exposure to a diversified basket of REITs despite the small outlay

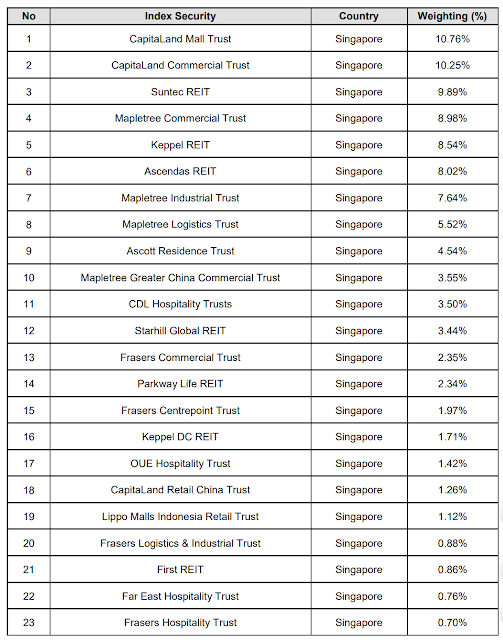

Index REITs

The ETF is supposedly going to track the above REITs based on the weightings. While there could be some tracking error as the Manager tries to replicate the index but investors can expect that their money to be invested in the above basket of stocks

Some of my concerns

- Low liquidity - Looking at the current trading volume of ETFs on SGX, trading liquidity is likely to be limited. However, investors could ask participating dealer to create or redeem the units

- Inefficient tax structure - It seems like there is a tax leakage as retail investors who invest in the REITs directly will be "better off" than investing through the ETF even though they will probably not "feel" it as it will not be so evident. See tax treatment for individuals by IRAS versus tax treatment for the ETF below.

Page 66 of the prospectus: "Taxable income distribution from Real Estate Investment Trusts ("REITs") listed in Singapore derived by the Fund will generally be subject to tax withheld at source at the prevailing income tax rate, currently 17%. Such taxable income distribution derived by the Fund is a non-Designated Income and will be subject to tax at the prevailing income tax rate, currently 17%, which could be offset by the tax withheld at source. The gains or profits derived by the Fund from the disposal of units in REITs listed in Singapore are Designated Income."

- Lower returns. The targeted yield of 4 to 5% after tax is not high enough for me for this asset class

Fees involved

- Transaction fee and Duties of $500 per $50,000 means investors who subscribe to the ETF incur a 1% creation charge. The rate is similar to placement fees in an IPO, except that this is not an IPO. Investors who didn't sell through the exchange but via redemption subsequently will incur a 1% redemption fee as well

- Manager's Fee of 0.5% per annum

I didn't comment on the fee levels as you don't expect this to be created for free isn't it? So you have to access for yourselves whether you are comfortable with the fees you are paying

Mr IPO's views

The ETF is great for retail investors who wants to start their retirement plans and wants to build up their portfolio in a disciplined way but do not know how to choose the REITs. It is a safe way to build up a diversified portfolio from day one. To me, the best way to invest in this ETF is to set aside a small amount of cash regularly and nibble at the ETF through SGX.

For investors who are more savy and have more capital, my view is that you are better off creating their own "index" of REITs. There is no point paying for low liquidity and low returns and incurring the transaction and manager's fees. I will give it a miss personally. If you have $50,000 to invest, you can start creating your own portfolio and enjoy a better after tax returns. 😎 Maybe i can charge 0.5% as advisory fees next time? 😋

Comments

For retail, it's min $1K & in additional blocks of $1K.

Yeah ... all the fees add-up will be rather high for a pure passive REIT ETF whose main aim is for income & not capital growth.

Just the basic 0.5% annual mgmt fee is equivalent to many smart beta / alternative / active ETFs on US exchanges. Arrgh...