Kimly Limited ("Kimly" or the "Company") is offering 173.8m shares at $0.25 each for which 170m shares is via placement and 3.8m shares via a public offering for a listing on Catalist. The offer will close on 16 March 2017 at 12pm and trading will start on 20 March 2017. The market cap based on the IPO price is S$288.7m.

Principal Activities

Kimly is the largest traditional coffee shop operator in Singapore. It operates and manages coffee shops under the "Kimly" brand and food courts under the "foodclique" brand. It has 64 food outlets of which 56 are coffee shops, 3 industrial canteens and 5 food courts in tertiary institutions. The 64 food outlets are currently running at 98% occupancy rate. In addition to running coffee shops and food courts, the Company also operate 121 food stalls including 36 "mixed vegetable" rice stalls and 43 dim sum stalls.

Financial Highlights

The revenue has been growing at a CAGR of 7.6% over the last 3 years from $148.8m in FY2014 to $172.2m in FY 2016. Based on the unaudited pro forma, the profit attributable to owners grew by a CAGR of 9.9% from $20m to $24m during the same period.

According to the prospectus, if the service agreement is in place, the EPS will be 2.01 cents for FY2016. This translate into a historical PER of around 12.44x. Assuming a 50% payout, the implied dividend yield is around 4%.

Assuming EPS grow by 5%, the EPS will be around = 2.01 x 1.05 = Singapore 2.11 cents. That translate into a forward PER of 11.8x and dividend yield of around 4.2%.

Use of Proceeds

Nothing controversial. Majority of the proceeds will be used to expand and improve its productivity and efficiency.

Substantial Shareholders

Mr. Lim Hee Liat is the substantial shareholder with ~42% stake with other founding members. There are 2 institutional investors - namely Vanda 1 and ICH Gemini Asia.

Vanda 1 is managed and controlled by

Heliconia Capital Management. Heliconia also invested in Jumbo as a cornerstone investor in October 2015. My write up on Jumbo is

here. The presence of Heliconia as pre-ipo investor bodes well and both Vanda and ICH will be subject to lock-up. The effective price paid by the pre-IPO investor is around 20c. I expect both investors to be vested for the longer period post IPO.

What I like about the Company

- Recession proof business. Coffee shop culture is part and parcel of our lives and there is demand for "cheap" food during good times and bad

- Highly cashflow generative business. You need to pay cash before you can get your fix of kopi every morning. On that note, the Company has no debt on its balance sheet and will have cash of $74.5m after the IPO

- Financials are audited by Ernst & Young, a big 4 audit firm

- The management is experienced and proven team. The founder started the business in 1990 when he was only 24!

- There are low hanging food which efficiency and cost savings can be achieved, such as setting up a central kitchen and improving the "cashless" payment system for younger customers

- Intends to pay at least 50% of net profits attributable to shareholders as dividends

- Insiders (one ED and 3 associates of ED) are supporting the IPO and intends to subscribe up to 10.8m new shares

- The base salary of the management team is reasonable and not excessive and the service agreement helped provide an alignment of interest

Some of my concerns

- Low barriers to entry and highly competitive industry. It is not exactly difficult for a consortium to buy up coffee shops and start running them. As such, there are many competitors in this space. Competitors include Broadway, Chang Cheng, S-11, Badaling, Kim San Leng, Koufu and Kopitiam

- The NAV is only 4.56 cents versus the IPO price of 25 cents. In other words, you are paying a premium to "buy into the coffee shops"

- The labor crunch and lack of Singaporeans willing to work in these sectors may affect the business operations and future growth

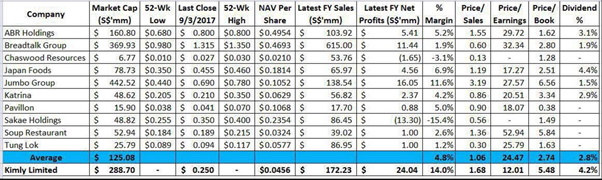

I received the above table from my friend and it looks fine. Helped me save time as i don't have to recreate my own list. The peers are trading at an average PER of around 24x! Japan Food is trading at around 17x PE and at 4.4% yield.

Assuming the "fair value" is 15-18x (i am being conservative here), the fair value of Kimly based on the forward EPS of around 2.11 cents is between 31 cents to 38 cents. If it trades up to more "unreasonable" levels of 18-22x, the fair value will be between 38 to 46c. I will be more conservative here and expect the price to debut between 31 to 38 cents.

My Chilli Ratings

I am giving it a 3 Chilli ratings. Hoot ah!!!

The IPO is priced very attractively vis-a-vis its peers. This is a good chance to own some coffee shops that is highly cash flow generative, has no debt and gives you a yield of more than 4%!

(Do note that Mr. IPO is vested hence the view is super biased)

Comments

next jumbo, shooting up after IPO. 20% for first trading day should be no big issue

I like your reply MR IPO......haha

For CAGR, is it (24/20 power of 0.5)-1

For EPS (Net income- div on preferred stock)/average outstanding shares, 24,039,000/1,154,786,732= 2.08. How do you get 2.01 for FY2016?

For the dividend yield at 4.2%, is it 24 039,000 x 50% (assume payout 50% profit)/1,154,786,732=0.01, 0.01/0.25 (share price)=4.2%?

How do you derive the fair value of 31-38 cents? is there a formula?

Appreciate your guidance and many thanks for your write-up.

PS: i am not trying to find fault with your article.

Fan of Mr IPO

I note from the offer doc that it pertains to the employment of the 2 EDs (Mr Lim Hee Liat and Mr Vincent Chia) in the Company. Are you basing your PE on the assumption that the 2 EDs achieves the highest incentive (PBT > 30m)?

Based on the audited figures, and being conservative, the PE should be 20X.

Last question, when you said that the company has no debts, are you saying that the company is in a net cash position from the cash flow statement?

I just applied 100 lots. Hope I get some shares for kopi $.

Tks.

Did you manage to get placement or via ATM?

Regards

The prospectus also mention that he is estimated to be paid a salary between 250K to 500K in FY2017. Being a substantial shareholder post IPO (~42%) plus his 100 million ++ networth, am not comfortable that he still intends to remunerate himself so generously. My personal opinion - this does not reflect best interests for the minority shareholders.

Yea still damn confusing cos diff ppl use diff standard now

I heard this from the news. May I know will this affect the IPO opening price?

Thank you.

Will this stock's price be like Jumbo, Jumbo 1st day trade very high and many of those vested quickly sold off on the 1st day, but Jumbo the next few days to next few weeks rose even much higher than it's 1st day price!

Do you know the website link for IPO balloting result? Thank you :))