MoneyMax Financial Services Ltd ("MoneyMax or the "Company") is offering 53.8m New Shares at $0.30 each for a listing on Catalist. The offer comprises 51.8m Placement Shares and a paltry 2m Public Offer. The prospectus is

here. The market cap post IPO is around $106m.

The IPO will close on 31 July 2013 at 12pm.

Principal Business

The Company is a leading market player in the pawnbroking business. In other words, it is a now a "glorified and esteemed" money lender for fast liquidity and lender of last resort (other than the illegal loan-sharks) as seen by the advertisements using Mark Lee (and Michelle Chia for its key competitor).

Island-wide Coverage

The Company has 27 outlets in Singapore and seems like they are everywhere in Singapore. The questions you have to ask is whether they have reached their maximum potential? Can they bring their business model elsewhere?

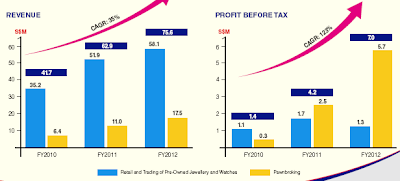

Financial Highlights

You can see an interesting trend. The retail trading of pre-owned jewelry generated a lot of revenue but little profits whereas the pawnbroking business generating little revenue but contributed a lot to the profit. As i told you above, it is a glorified and legalized "lender of last resort" (didn't want to use the name of a fish here). The profit margin of retailing is 2.2% whereas that of pawnbroking is 32.6%!

Based on the post-invitation share cap of 353.8m shares, the EPS assuming the service agreement is in place is around Singapore 1.485c, At the IPO price of 30c, it is listing at a historical PER an unbelievable 20x! I hope the forward earnings (which i am not privy to) better justify this high PE.

Use of Proceeds

The IPO proceeds will be used mainly to expand outlets and for working capital.

Dividends

The Company did not pay out any dividend since incorporation (which is good) but did not commit to pay out any dividend in future either. I would expect the cash dividend to be paid once the business reaches maturity.

Shareholders

The shareholding structure is pretty simple. The founders (more known as the business owners of Soo Kee and SK Jewellery) owns about 84.7% of the Company post listing with the public holding only the remaining 15.2%. I understand from sources that the founders even helped placed out half of the public shares (to families and friends?), which explains why the demand is very hot and is very difficult even to lay hands on the placement tranche.

Story on the pawn-broking industry here

This is what i heard from a person who works in this industry. I am not sure if this is true but you can tell me. There are two types of licenses issued. One is the type of license held by Maxi-Cash and Money-Max. They come under the 'new type' of licenses issued where they can operate more outlets with less paid-up capital but they have to fulfill certain conditions. I understand the new type of license was given because Singapore wants to clean up this industry which in the past, was more 'shady' and less 'institutionalized'. You can see that Moneymax is actually "CaseTrust" accredited!

Key Competitor

Similarities between Money Max and Maxi-Cash

- Both the owners own a Jewellery business (Maxi-Cash owners own the Goldheart, Lee Hwa and Aspial chains)

- Both shares are listed at $0.30. (I believe Maxi-cash has a subsequent share split)

- Both users local artistes to as their brand ambassadors.

- Both are listed at historical PER of >20x

- Both have outlets all over the place. (Maxi-Cash has around 29 outlets)

Maxi-Cash

Maxi-Cash's public tranche of 2.25m shares was 88.5x subscribed. The IPO price (adjusted to $0.208) went up by 30% on its first day. After one year, the share price has more than doubled and the market cap now stands at $200m. Maxi-Cash is currently trading at a multiple of 43x! For FY2012, Maxi-Cash reported revenue of $100.5m and net profit of $4.2m. The adjusted EPS is around 0.975 cents. Hence from a valuation angle, MoneyMax offers better relative (not absolute) value vis-a-vis Maxi-Cash. However, Maxi-cash paid a dividend last year.

Will MoneyMax follow the footsteps of Maxi-Cash as well in terms of share price movement?

What i like about the Company

- Simple business to understand.

- Strong historical growth trajectory

- The Company "discontinue" sales to Soo Kee and SK Jewellery from corporate governance perspective.

- Offers relatively better "value" than its key competitor, Maxi-Cash

My concerns

- Is the company reaching saturation point in Singapore?.

- Is business scalable beyond Singapore since this is a licensed industry?

- High valuation

- Small Float

Mr IPO's views and ratings

On one hand, my mind is telling me the company is over-valued on a stand-alone basis, on the other hand, my heart is telling me that this will somewhat follow the footsteps of Maxi-Cash. The fact that Maxi-Cash is grossly over-valued is "helping" the case to push for a higher Chilli ratings for MoneyMax. I understand the demand for the placement tranche of MoneyMax is very strong. Given the small public float and well organized placement exercise, I will give it a 3 Chilli ratings for this IPO. Please note that I am vested.

Comments

See the announcements from maxi-cash

I thought you do not like such business, referring to your maxicash post, so why now become vested

Your disclosure and openness of shares allotted to you be it through placement or balloting will certainly attract a lot of viewers to your website.

Of course you have the final say.

I am just sharing with you what I personally feel and what I gathered from many of my kakis.

I understand BVPS= NTA/share; thus, how is it fair to say that at the same 30cents IPO price, both are somewhat equally good propositions?