Ever Glory United Holdings Limited ("Ever Glory" or the "Company") is placing out 14m shares at $0.22 each for an IPO on Catalist with a market cap of $18.63m shares. The IPO will close on 16 May 2023 at 12pm.

I will not spend too much time since there is no public offering and I am not in the placement tranche. Having said that, the IPO market here is attempting a "come-back" and there should be more IPOs in the next 1-2 months.

Principal Business

The Company is a Singapore-based mechanical and electrical ("M&E") engineering service provider specialising in a wide range of M&E engineering services. The services involve projects in both public and private sectors, such as development or redevelopment of HDB residential flats, private residential properties, private schools, mixed-use properties, commercial buildings and industrial buildings.

Competitive Strengths

According to the prospectus. the Company has the following key strengths:

- Well established presence in the Engineering market in Singapore

- Comprehensive range of M&E engineering services

- Experienced and dedicated management team

- Wide network of customers, suppliers and subcontractors

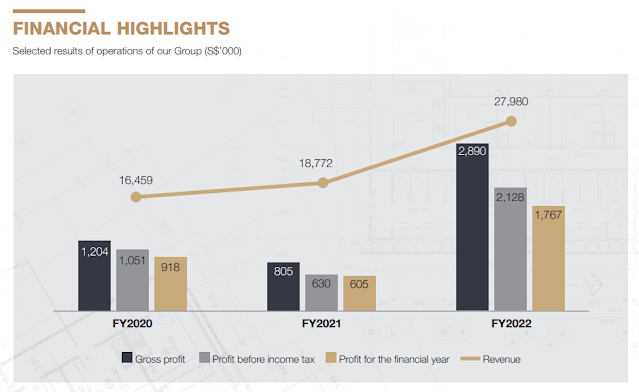

Financial Highlights

The adjusted EPS (based on service agreement and enlarged share capital) for FY2022 is 2.09 cents and that translates into a PER of 10.5x.

According to the prospectus, the Company's order book as of 14 April 2023 is S$112.86m.

Dividends

The Company intends to distribute at least 50% of its net profit for FY2023 - FY2025) as dividends.

Mr IPO views

This is a reverse S-Chip rag to riches story 😆. Both Mr. Sun Renwang and Mr. Xu Ruibing were born in China, came to Singapore and became a 管工 or engineer initially before "rising through the ranks". In some ways, it demonstrates that Singapore can be a land of dreams if you work hard enough. Both men currently hold an equal 46.4 percent interest in the company. After the placement, their deemed interest is expected to drop to 38.7 per cent each.

I guess M&E Engineering services are pretty competitive. Many of the listed peers went out of business or lost their focus over time and went into a state where no investors really care about their existence and it is tough for them to raise money thereafter. My gut feel is that the Company intends to venture into property development over time and having a listed vehicle may lend itself more credibility.

I tried to recall who the most recent M&E services company is and the closest is probably

Alphina Holdings. That company's market cap has since dropped from $57m to $22.6m, and never went above its IPO price. I would say that Alphina was probably over-valued whereas Ever Glory is now starting off from a lower base where the market cap is $18.63m.

The other M&E Company -

DLF Holdings was also quite similar, having changed its name to OIO Holdings, ventured into blockchain and share price was hyped up at one time but now trades into oblivion.

Anyway, not many encouraging stories to tell on this one but since there is no public tranche, you can't subscribe unless you really want to. I would have given it a pass (zero chilli) be it public or placement tranche. The sector is just not enticing.

To conclude, nothing to be excited about and the hot weather is not helping with the IPO drought that we are witnessing here. This is not the stock that SGX is looking for to revive the IPO market to its former glory (pun intended).

Comments