VTAC, also known as Vertex Holdings SPAC, is going to be the first main-board listed SPAC in Singapore. Based on the preliminary prospectus, it will be offering 11.8m Units at $5 each where 11.2m will be via placement and the balance for the Public Offer.

Including the Sponsor and Cornerstone Units, the market cap of VTAC will be between $200 to $211.8m, depending on whether over-allotment is exercised. The book building exercise will end on 13 Jan 2022 and IPO will run from 14 Jan to 19 Jan 2022 and VTAC is expected to be listed on 21 Jan 2022.

Vertex is tasked to spearhead this initiative on SGX

It is natural that Vertex, being a wholly owned subsidiary of Temasek and a reputable manager in the venture capital space, was given the task of raising the first SPAC to ensure that it will be a roaring success. It cannot and must not follow the path of the business trust regime.

Given this is a blank cheque company, it means there is no real business to evaluate. In other words, you are no longer evaluating the business of the listco but buying into the SPAC based on the reputation and track record of the Sponsor.

Vertex, the Sponsor, is a leading global venture capital firm

The Sponsor is Vertex Venture Holdings ("Vertex"). According to the prospectus, Vertex is the key differentiating factor on why you should invest in this SPAC. It has a global network and deep localised knowledge with an active portfolio of over 200 companies. It is known to be a credible long term value-add partner and has a strong track record of over 30 years.

Sponsor incentives is well aligned with VTAC investors

The Sponsor has tried to ensure that its promote shares are aligned through both time-based and price-based measurements.

Investment Opportunity

VTAC's mandate is to acquire a business with a core technology focus within 24 months of its listing. The business must have highly differentiated products and scalable business models, with the aim of improving people's lives by transforming businesses, markets and economies.

Some of the criteria used in evaluating the businesses include the following:

and they are likely to be found in the following investment themes:

- Cyber Security and Enterprise Solutions

- Artificial Intelligence

- Consumer Internet and Technologies

- Financial Technologies

- Autonomous Driving and New-Energy Vehicles

- Biomedical Technologies and Digital Healthcare

Below is the pictorial view of the opportunities that are at the forefront of technological transformation.

The Offering

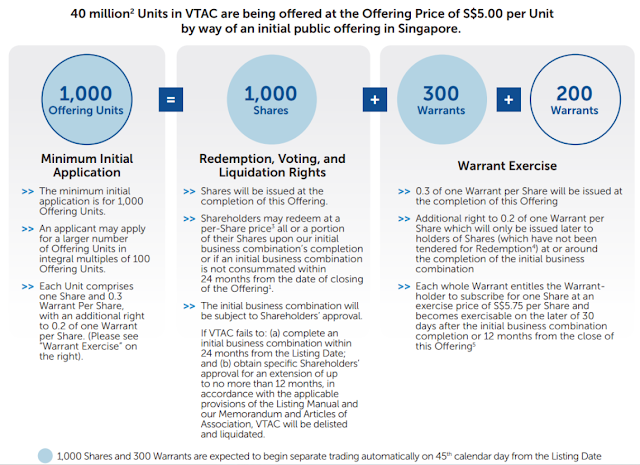

It is important to understand what the offering is about. Every 1,000 Offering Units will become 1,000 shares and 300 Warrants to be issued on the 45th day and 200 Warrants to be issued prior to the business combination. The warrant is exercisable at $5.75 per share. The entire gross proceeds (100%) will be placed in an escrow account.

If VTAC fails to acquire any business within 24 months and fail to obtain shareholders approval to extend for another 12 months, then VTAC will be delisted and liquidated.

Life Cycle of VTAC

If there is a page you need to read in the prospectus, this is the one. Basically it outlines the key events, the things to take note of and what you can do. If I can sum it up, apply for the IPO, wait for the EGM to vote whether you want to redeem your shares and vote for or against the initial business combination. You can, of course, sell your shares and warrants at any time.

Cornerstone Investors

VTAC has also secured 13 high quality Cornerstone Investors to subscribe for 22.2m Cornerstone Units to raise S$111m.

The who's who are here today, playing ball and attending the inaugural SPAC tea party. You name it you have it. I will re-categorise it for your convenience:

- Ah Gong - Yes, this is the real ah Gong and not via one of its wholly owned but independently run units. This is Temasek Holdings (via Venezio Investments Pte. Ltd.). Temasek don't usually anchor a local SGX listed IPO and this is probably a rare exception to show support for the first SPAC

- Hedge Funds - Dymon Asia Multi-Strategy Investment Master Fund - a hedge fund founded by Danny Yong as well as Linden Capital and Segantii

- Asset Managers - Fortress Capital, Fullerton Fund Management Company, Lion Global, Target Asset Management, UBS

- Family Offices - Family offices of Alan Wang (Asdew) and Nouri Holdings (Greenpark)

- HNWIs - Private banks clients of DBS

Board and Senior Management Team

This is the team that has been entrusted to ensure SPAC is off to a good start.

What I like about VTAC

- Reputable and quality Sponsor - This is as good a sponsor as you can get to kick off the SPAC party. If you can't play SPAC via VTAC, you can forget the rest. Vertex is one of the leading VC companies in Singapore and has ample deal flows and experience to find a decent deal for SPAC listing

- High quality cornerstone investors - as mentioned above, everyone who was deemed worthy and invited to the party, came. This is as good a list as you can get in any cornerstone names. Just don't expect all of them to be long-term investors. They are here for the party and may get out when it pops.

- 100% of the gross proceeds will be placed in escrow - none of the cash will be touched even though the Sponsor needs to ensure 90% of the proceeds are in escrow

- Downside protected - Downside is protected as I can elect to redeem the shares later if I don't like the business that was being acquired

Some of my concerns

- SPAC seemed like a bubble and most share prices fell after the De-Spac - the SPAC fever has died down quite a fair bit in the United States and we are just playing 'catch up'. See additional comments on Grab below and most SPACs underperformed after the business was acquired

- Promote just enriches the Sponsor with zero value add - I hate the sponsor promote. If the Company is good enough, it should have been listed through the usual means so why should the sponsor be rewarded to help skirt the stringent listing requirements? It is almost like encouraging and rewarding bad behavior

- No business to evaluate - This SPAC is basically a "trust me" IPO. There is no business for me to evaluate and I can't even decide if the business is attractive or acquired at the fair valuation but at least I get to vote at the EGM later on whether I want to redeem my shares and vote for or against the acquisition

Grab was listed via a SPAC

The blank cheque company phenomenon was "very hot" early last year in the United States and interest has since waned due to issues such as Nikola

fraud and poor stock performances.

Another 'home grown' unicorn,

Carousell, was recently reported to be in a US$1.5b SPAC talks with L Catterton and you will hear of more such "tech" companies that will become candidates for the Vertex SPAC.

Mr IPO Chilli Rating

I understand from grapevine that this IPO is extremely hot for the reasons I stated above - reputable sponsor, quality cornerstone investors and the ability to redeem your shares if you don't like the acquired business. Having said that, the SPAC market in the U.S. is clearly waning and looking at the share prices for most SPACs, it bodes well to 'run road' right before the De-SPAC.

My strategy is to subscribe for the IPO and sell into strength (positive sentiments) before the de-spac happens. I have placed some orders (via placement) for the IPO purely for to "support" the first SPAC. Looking at the number of shares available, it will be quite difficult to get the shares via both placement and public tranche. I will let you know my allocation rate through my Facebook IPO page (so do click "like" to follow the page).

I will give it a 2 Chilli Ratings even though I understand from someone close to this IPO that it is a very "hot" issuance. In fact, I should have given it a 1 chilli rating as fundamentally there shouldn't be any pop at IPO because no business has been identified and the value is based on the cash in the bank. Why should anyone pay a premium for cash?

Polling Time - Are you going to Subscribe for VTAC (IPO should start on 14 Jan 2022 based on the timetable i was given)

You can take the poll

here or click on the picture below.

Comments

Do u know how can i subscribe in the bookbuilding phase before public phase? use which broker? and must i be an 'acredidated investor' to qualify for this?