For information only - no detailed analysis as there is no public offering

Audience Analytics Limited ("Audience Analytics" or "AA" or the "Company") is placing out 26m shares at $0.30 each for a listing on Catalist, of which 18.2m are new shares and 7.8m are vendor shares. The IPO ends at 12 noon on 28 Sep 2021 and based on the IPO price, it will have a market cap of $50.5m.

Principal Business

AA was established in 2002 and the Company offers a range of solutions that give companies better understanding of their businesses so that they can make better decisions to grow.

Competitive Strengths

Business Strategies and Future Plans

Financial Highlights

According to the prospectus (page 35), the EPS for FY 2020 based on post placement shares of 168.2m shares is 1.75 cents. Based on the IPO price of 30 cents, this translates into a historical PER of 17x.

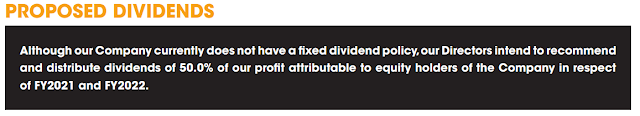

Proposed Dividends

Mr IPO Comments

AA is basically a publisher and awards organiser (similar to beauty pageant organiser) where in this case, it is to organise awards such as SME 100, HR Asia etc.

For a while, from the logo and the press release , I thought AA was a "business data analytics" company and positioned as a "SAAS - Software As A Service" business, which to me, was highly misleading given that such the SAAS service has not even been launched yet (targeting Q3 2021).

Obviously if you track the US market, SAAS companies trade at very rich valuation because of the recurring nature of the business model but AA is nowhere near this model yet. At this juncture, it is at best a media and exhibition company with its own portfolio of digital and print titles as well as exhibition business. You can read more about AA in the Edge article

here. Having said that, KGI securities find the valuation "attractive" and you can find the article

here.

Since there is no public offering, I will not be doing any analysis on the company.

Comments