Aztech Global Ltd ("Aztech" or the "Group") is offering 68.12m shares at $1.28 each for its IPO where 3.5m shares will be for the public with the remaining being placed out. The public offer will close on 10 March at noon and commence trading on 12 March 2021. The market cap based on the IPO price will be $990.4m.

History of Aztech Global Ltd

For new investors who need a history lesson, Aztech was listed in 2006 but privatised in Feb 2017 and at the point of privatisation, it was valued at $20.4 million. See old article

here.

The offeror said the delisting would provide company management greater flexibility to manage the existing businesses of the group while exploring opportunities without the attendant costs, regulatory restrictions and compliance issues associated with its listed status on the SGX. It added that Aztech has no present need for access to Singapore's capital markets and is unlikely to tap these markets to finance its operations in the foreseeable future. It has not carried out any exercise to raise cash funding on the SGX in the past five years.

The public offering of 68.12m and 8.88m cornerstone by the vendor and that amounts to 77m x $1.28 = $98.56m going directly to the pockets of the selling vendor. (I haven't even included the over-allotment option). Contrast that against the $20.4m valuation when it was privatised, the vendor made a lot of money just by delisting and relisting it. I haven't even mentioned the

roasted duck that was paid by the shareholders back then. Have the duck and eat it? Shareholders who voted against the privatisation are probably feeling aggrieved, not to mention

those who were previously burnt by it and he didn't even bother to attend

the privatisation shareholders' meeting.

So why is the market so forgiving and welcoming Aztech back with open arms after a short 4 years? Let's take a look at what happened from 2018 to 2020 and you can find the missing duckie too.

My only takeaway is that the market has a short memory. While I have not invested in Aztech previously, the whole episode just leaves a bad taste. You can say all you want about the rationale for delisting but you can't deny the fact that many retail investors were left high and dry by the same founder - Michael Mun. It is not as if a new owner took over and saved the company. This is the same person who led Aztech from day one, expand to non-core F&B business and to the doldrums. After he privatised the company, he sold the non-core businesses away, expanded into IoT and now has the audacity to ask the market to believe in him once more.

The question is whether he could have done the same without de-listing the Company but if he has done so, the outcome for him personally would have been very different as he owns a smaller % of the Company prior to de-listing.

As a mark of respect for investors who were previously burnt - the coverage below will be factual (i.e. from the prospectus) and minimal.

About Aztech Global Ltd

Aztech is a key technology enabler for the connected world of tomorrow, with a focus on providing one-stop design and manufacturing services. Its key products are IoT Devices, Data-communication and LED lighting products.

To put it simply, it is an OEM to brand owners. See picture below.

Key Investment Highlights

Key Financial Highlights

The Company managed to improve EBITDA margin from 5.2% to 15% from FY2017 to FY2019.

According to the prospectus, the Company is listing at a PER of 17x based on FY 2019 results., inline with other OEM manufacturers listed on SGX.

Business strategies and future plans

The Company is raising $198.4m, of which $50m will be used to expand its manufacturing facilities, $50m for expansion and M&A and $58.6m for working capital.

Cornerstone Investors and Over-allotment option

Aztech managed to garner support from a group of high quality cornerstone investors who agreed to acquire 163,880,000 shares. They include Affin Hwang, AIA, Eastspring, EPF (provident fund of Malaysia), FIL, Hong Leong, HSBC, ICH, JPM , Tokio Marine and the list goes on.

In addition, there is an over-allotment option to over-allot up to 13.6m shares to help stablise market if needed. I am really surprised at the blue chip list of investors.

You can see that the shares are held tightly by Michale Mun and not widely distributed, not even to his wife, sons or the management team.

Dividends

Aztech intends to pay 30% of its net profit after tax for FY2021 and FY2022

Management Team

Michael Mun is the CEO (aged 71) and he has probably groomed his son Jeremy Mun (aged 45) to take over him. Jeremy is currently the COO and Executive Director. Another son Ivan Mun (aged 39) is a Vice President in Sales & Marketing.

Peer Valuation

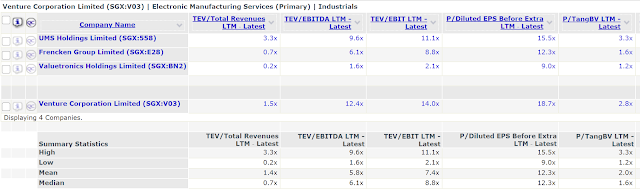

At 17x PER historical, Aztech is priced closed to Venture Manufacturing while many of its peers (including my favorite UMS) is trading at 12-15x.

Mr. IPO's chilli ratings

I am not sure why Aztech deserves a rating after what they had done in the past. It is not as if the Company is going for a steal. At 17x PER, you can buy Venture Manufacturing if you really like OEM exposure.

Alas, the Vendor is going to be have a huge pay day despite screwing up investors in the past (pardon my french), and with lots of reputable institutional investors backing him some more!

Having said that, I understand the placement tranche was pretty hot but the book building was done before the recent sell down on NASDAQ.

Will it be different this time? You be the judge but I am going to give him a zero chilli.

Polling Time

You can poll at this

link

Comments

To have given face in saying any thing neutral would have been a GREAT injustice to all investors .

HI-Five to you!

Karma will come around.

May justice be served to all who have suffered

This company should be closed down. Unfortunately Mr.Market forget things pretty fast and i may not be surprised if they get good valuation.