Credit Bureau Asia ("CBA" or the "Company") is offering 30m shares at 93 cents for its upcoming IPO of which 28.5m shares will be via placement and 1.5m for the public offering. Including the cornerstone investors offering of 28m shares, the market cap for CBA at listing is $214.3m. The IPO will close on 1 Dec 2020 at 12pm.

Principal Business

The Company is a leading credit and risk information solutions provider in Southeast Asia, providing credit reports to an extensive client base such as banks, MNCs, government agencies across Singapore, Malaysia, Cambodia and Myanmar. CBA provides data to help its customers make better-informed and more timely decisions by enhancing their risk assessment and decision making processes.

CBA business can be broadly categorised into Financial Institution (FI Data Business) and Non-FI Data Business.

- FI Data Business refers to credit bureaus that provide subscribing members - mainly banks and FIs - with access to credit information on individuals or corporates. CBA has established 3 credit bureaus. It is the dominant market leader in Singapore and the sole credit bureau in Cambodia and Myanmar

- Non-FI Data Business refers to the JVs with Dun & Bradstreet in SIngapore and Malaysia where they provide customers with a wide range of business information and risk management services through the D&B Worldwide Network. Dun & Bradstreet is listed on NYSE

If you have no idea what that means, let me explain in more layman terms.

Do you own a credit card or have a car loan with a bank? If your answer is yes, then your personal credit data is already lodged with CBA. This is the agency that aggregates data from different banks and agencies and then "rat" on you if you have been delinquent in your payments. For example if I have been late or not paying my credit card bills for more than 6 months, the credit card company will 'file' my records with the CBA and that will have a negative implication to my "scorecard". It will be flagged out when I apply for a credit card or loan with other banks. If you have a good credit score, you will get your credit card or loan approved quicker.

Funnily enough, i wrote this article - What is your

personal credit rating in Feb 2018, where I paid for my own credit rating with

Credit Bureau Singapore as part of the hiring process. This is a "data monopoly" business. The more data you give to CBA, the more powerful they become.

Group structure

Financials

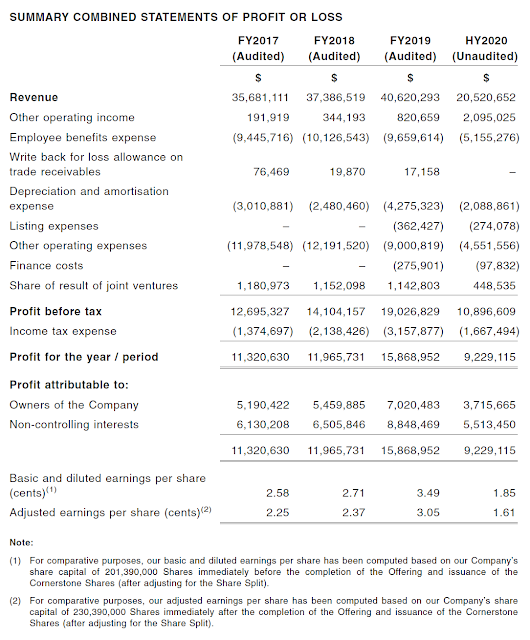

This is a relative stable business with revenue and profits growing at a CAGR of 6.7% and 16.3% respectively over the last 3 years. For FY 2019, revenue was $40.6m and profit was $15.8m. The profit attributable to CBA was around $7m. The adjusted EPS based on the enlarged post IPO shares capital is around 3.05 cents. Adjusted EPS for 1H 2020 is 1.61 cents.

Given that the 1st half of the year is likely to be "worse" than the 2nd half due to lock down in Q2, I would expect the EPS for FY2020 to be at least 2 x 1.61 = 3.22 cents. Based on the IPO price of 93 cents, that works out to be a PE of about 28.88x. Given that the Myanmar operations started in Q4 of this year and the award of the credit bureau for money lenders in Singapore for 3 years, they should hopefully contribute positively to the numbers for FY 2021

Assuming EPS continues to grow at 12% (using HY20 against HY19), the EPS for FY2021 may grow to 3.22 cents x 1.2 = 3.864 cents. Based on the dividend payout ratio of 90%, the DPS will be 3.48 cents and that translates into a dividend yield of 3.74%. It also translates into a forward PER of 24x.

Shareholding and Cornerstone Investors

The cornerstone investors subscribed for 28m shares and they included Aberdeen Standard, Affin Hwang Asset Management, Eastspring Investments and Tokyo Shoko Research (credit reporting agency in Japan). While they are not subject to any lock-up, they are highly regarded and provided an additional layer of diligence and affirmation on CBA. Kevin Koo, the founder, will continue to own 67% of the Company after the listing and is required by certain regulations to maintain a certain threshold

Use of proceeds

The Company is raising $27m onad has earmarked $11.8m for strategic investments and regional expansion. It has the right of first refusal for some bureaus in Indonesia. The value of this franchise will only be fully developed if it can be the dominant player in the entire SEA and become a one stop shop for many of its clients. I understand from management that they are raising funds to expand quicker and I agree that they must "move faster" to take full advantage of the first mover advantage they have in the last 2 frontiers of Cambodia and Myanmar

What I like about the Company

- Data is the new oil - in the new digital economy, data is more valuable than ever! Whoever "owns" the proprietary data" owns an invaluable intangible asset and the more data you collect, the more valuable the company becomes. Through the use of artificial intelligence and big data analytics, the Company is well positioned to take advantage of its monopolistic positions in these 3 countries - Singapore, Myanmar and Cambodia. Do note that CBA is not profitable in Malaysia given the competitive landscape

- First mover advantage and sole credit bureau in Cambodia and Myanmar - CBA previously had the first mover advantage in Singapore and is now the dominant player enjoying strong cash flows. It has now established the first mover advantage in Cambodia and Myanmar where it is the sole credit bureau. This "monopoly" position will create a moat against late comers when they scale up and the potential for Cambodia and Myanmar can be immense if they can develop into a dominant position, like what they have done in Singapore

- Strong growth potential in Myanmar and Cambodia - The 2 developing countries are largely "untapped" with good growth potential as the credit card penetration and banked population are at low levels compared to the more developed countries. Having said that, it may be a while before these two countries turn in substantial profits. Singapore currently contributed to the bulk of profits before tax of 97%, Cambodia contributed only 7% of PBT while Myanmar has just started. Malaysia is unfortunately a drag on the profitability

- High margin and cash flow generative business - CBA has no debt or borrowings. CBS is a "cash cow" within the Company and has been generating strong cash flows for its owners. CBA's EBITA margin is more than 50% and has "promised' to a dividend payout ratio for no less than 90% for FY2021 and FY2022. They have formed a strong and dominant position in Singapore and most of the profits are derived here. Given the strong compliance nature here, financial institutions and corporations will continue to rely heavily on CBS to provide those services and CBA can make full use of this dominant position to expand regionally. The dividend yield of >3% also looked attractive

- Reputable cornerstone investors - CBA managed to attract well regarded institutional investors to its IPO and they subscribed for 28m shares, which is close to the size of the public offering. Tokyo Shoko is likely a strategic investor and the rest are the traditional "long-only" investors. This bodes well for the debut as they are unlikely to "flip" in the near term and their investments would likely be a medium term hold for most of them

Some of my concerns

- JVs may not always work out - While CBA has long standing working relationships with its key JV partners, there had been disagreements and disputes in the past. The prospectus cited Equifax and Dun & Bradstreet that had disagreements but were eventually amicably resolved. As Dun & Bradstreet is a major customer and major supplier to the Non-FI Data Business, any disputes with D&B will be detrimental. In addition, CBA does not have majority control of their associated companies in Cambodia and Myanmar. This is especially true for Myanmar, which just started operations recently and will need time to scale

- Cyber security is of utmost importance - Where data is involved, especially if those data are stored in "cloud", cyber security to CBA is highly critical. Any breaches on the data security will affect the company as it may run foul of the legal obligations

- Board composition has no diversity and does not include someone with legal experience - With all due respect, all the board members are male and the independent directors are from the 59-70 age group. Considering the legal obligations of credit bureaus, I would have preferred the board to include a practising lawyer with relevant expertise and a female director.

- Credit Bureau business may one day be disrupted by fintechs - While the Company enjoys a "monopoly" in Myanmar and Cambodia, they are not scalable yet as the economy and capita per person are still low. If you look at how Ant Financial (or Alipay) became a "giant" over time in China, it is because they scaled through the app and this could be the next trend in SEA that is currently under-penetrated and under-served. The biggest cash cow for CBA is Singapore because of the strict regulatory regime governing monitoring of indebtedness. While CBA touted that there could be potential business from the digital banking licensees, one of them could potentially disrupt its business. Singtel and Grab have jointly applied for a full digital banking license. Imagine if you use the Grab wallet for everything from payments to banking, the ecosystem may not need to source data from CBA as Grab would have the payment history, spending patterns and use those data to evaluate the user's credit worthiness and provide loans to them. I guess that is the reason why they have Kee Lock from Vertex Venture as one of the directors, who can keep the management apprise of the latest trends in this space

Mr IPO Chilli Ratings

Despite the perceived high PER valuation, I like this Company for the reasons stated - no debt, highly recurring and cash flow generative, limited competition and dominant player in Singapore and first mover advantage with strong potential growth in Cambodia and Myanmar. The attractive dividend yield in the current low irate environment will also attract longer term investors as evidenced by the blue chip cornerstone investors. It is a 3 Chilli rating for me - Hoot Ah !!!

Do note that Mr. IPO is invested through the placement tranche. For readers who want to know if you can still apply for the IPO public offer even when they have received placement shares, the answer is yes, but you can only apply once.

Will you subscribe to the CBA's IPO?

Please take the poll

here

Comments