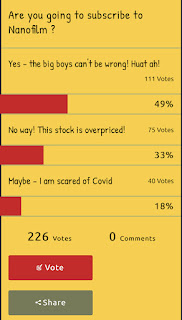

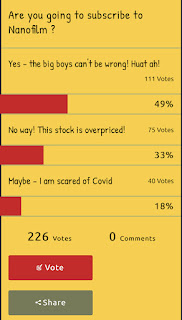

Thank you for participating in the survey (which is still running).

The interim results showed that 49% will be subscribing. I also received a few messages asking if I will be subscribing. I decided to share this post so that you can go through my thought process.

I was ready to try my luck on Sunday when I was writing my post, but not so sure anymore as sentiments has turned.

I have written previously (some many years ago) that for IPO pop to happen, the most important is the timing.

For IPO to "pop" on day 1, factors include right investors sentiments, right valuation and right market.

I mentioned in my Sunday post that I was struggling to give a 3 chilli ratings given the rich valuation but it is the blockbuster IPO on SGX for 2020.

Now that we are one day away from the closing, I don't think the sentiments is conducive as investors are currently in a "risk-off" mode, ie people are taking money off the table due in part to uncertainties over US election, rising Covid cases again and most stock markets are in a correction mode.

Given the above factors, I think it will be more challenging for Nanofilm to pop despite the stellar institutional investors base.

As such do proceed with caution if you are intending to flip.

As for myself, I will give it a pass for now given the approval process I need to go through and consider it for longer term investment next time.

Happy nanoing !

Comments