Resources Global Development Limited ("RGD" or the "Company") is offering 15m shares at $0.20 each via Placement. Given this is a small placement, i will not spend too much time on this. The IPO will close on 29 Jan 2020 at 12pm and starts trading 2 days later at 9am.

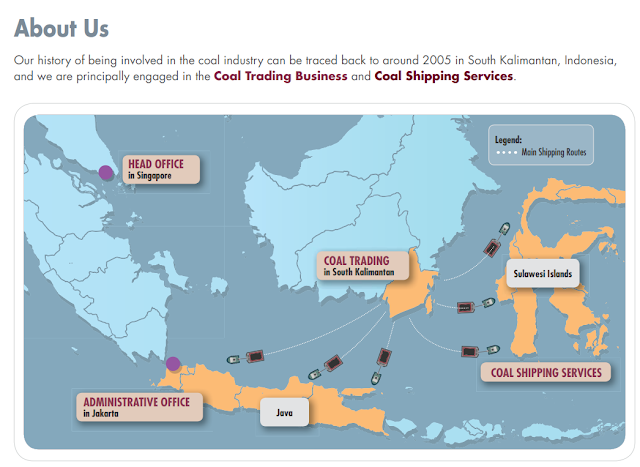

The Company is principally engaged in Coal Trading and Shipping services. The Company is able to procure coal from 3rd party coal mines and coal mines related to its founders. The Company also provides chartering services of tugboats, barges and bulk carrier to transport coal within Indonesia.

Competitive Strengths

As you can see from the prospectus, the Company's regard its competitive strengths as having reliable supply of coal, established reputation and long standing relationship, having a young fleet and experienced management team.

Business plans and financial highlights

It is interesting to note from the prospectus that revenue improved significantly in FY2018 to $44.8m but the profit stagnated at $4m (pro-forma at $3.3m - see page 26 of the prospectus). The profit dropped even further if you use the pro forma 1H2019.

The Company is however, very keen to highlight its "cash flow from operating activities" , which had been positive since FY2016.

What I like about the Company

- IPO price is close to book value and listing PER seemed "low enough"- The NAV per share is 18.3 cents based on the prospectus. This means the investors are getting the company at close to book value at 20c. The listing PER is in single digits.

Some of my concerns

- The coal commodity business is cyclical in nature- The company is exposed to commodity risk - in coal. This business is highly cyclical and can be highly volatile

- It violates most ESG policies - The Company is in a declining industry as more banks requested not to lend to companies in the coal business. You can see that many banks are trying to wind down lending to coal-fired power plants (see article here). This will have a downstream impact should they extend this ban to all "coal-related" businesses.

- The market cap and float is small - The market cap is only $18m and listing will be tightly controlled with only 15m shares available via placement.

- Financial projections will be difficult - Looking at the financial statements, i have no clue why coal trading is able to ramp up so repaidly when the coal shipping business seemed to be suffering a downturn.

My Chilli Ratings

I am not going to spend too long on this. I don't like the coal (commodity) sector and i don't see why coal is going to be a growing industry when the banks are trying to curb lending to coal-fire powered plants. I will give this IPO a miss (not that they are targeting retail investors anyway)

Happy IPOing!

Comments