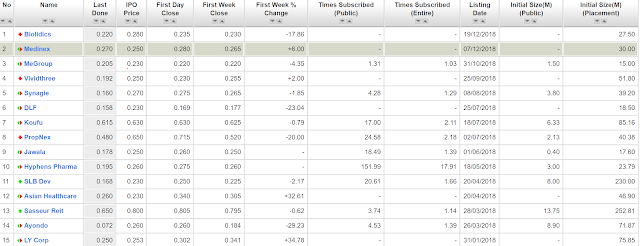

2018 is a year to be forgotten for IPOs on the Singapore Exchange. SGX "failed" to attract any significant listings and most of the listings are currently underwater as shown by the table below.

(Source: Shareinvestor.com)

Mr. IPO has been reporting his IPO tikams (performances) since 2012. You can search for the prior posts

here. How did he perform in 2018?

Contrary to even my own expectations, 2018 turned out to be the best year i ever had because of a few significant "bets".

Majority of the gains came in the first half of 2018 and significantly from the RTO of Memories Group, which i took a significant placement shares , so technically it is not an IPO but I have classified it in the IPO category. The top 3 gains are as follows:

- Memories Group $ 19,471

- Asian Healthcare $ 8,371

- SLB Development $ 3,366

While i have fared well in the IPO tikams, my personal portfolio suffered a big loss when i wrote down Hyflux Perps to 10% of its par value. At this juncture, I am not even sure if i can recover the written down value and i will blog about them in a separate post on my passive income pursuit.

I think 2019 will continue to be challenging for the Singapore IPO market with SGX struggling to attract companies to list here. The market should continue to stay volatile in the first half and beyond that, it will be challenging to predict how the markets will perform.

That is all from me for now. I take the opportunity to wish all readers good health, happiness and a wonderful 2018!

Comments