I don't really cover ETFs but as requested, here you go . . .

New Issuance

Nikko Asset Management launched a SGD investment grade corporate bond ETF for retail investors. The offer closes on Aug 17, 2018. Trading will start on 27 Aug 2018.

Benchmark

During the offering period, the minimum investment is 50,000 units and the ETF will track the iBoxx SGD Non-Sovereign Large Cap Investment Grade Index, a proprietary index developed for Nikko AM.

Market Making

Flow Traders Asia and Philips Securities will be making market for the ETF post listing and have to make market 85% of the time with both bid-ask trades. While the spread can be as wide as 2%, it is expected to be tighter at around 30-50 bps (my guess).

Great for retail investors - Diversification

The ETF is great for retail investors, as these investment grade bonds are, ironically, available only to accredited investors at a minimum clip size of $250,000. With the ETF, you can achieve diversification with as low as $1,000. In addition, there is low correlated with Singapore equities, meaning that investors in ETF will achieve some level of diversification.

Being denominated in SGD, the Fund poses no currency risk for local investors.

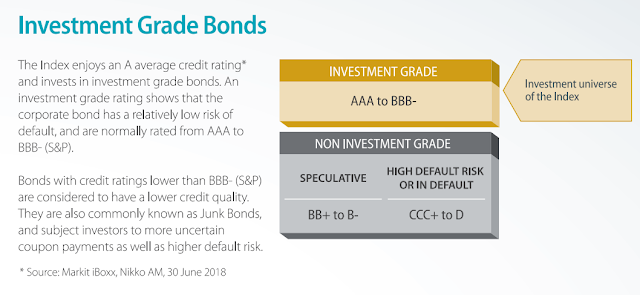

High quality bonds

The bonds comprise a large allocation to statutory boards such as HDB and LTA, and

corporate bonds issued by blue chip companies, such as DBS, UOB, Singapore Airlines, Keppel Corp and Capitaland. The bonds itself must have a minimum issuance size of $300m to ensure there is sufficient liquidity.

Expected Yield

The expected yield of the ETF at issuance is around 3.22% (gross) and with expense ratio of 0.3% per year, the net yield is around 2.92%. The expenses will be capped at 0.3% by Nikko AM.

Fund Details

What I like about the Bond ETF

- Affordable - Finally we are able to assess a portfolio of investment grade bonds rated from BBB- to AAA+ for as low as $100! You can buy the ETF like stocks through the exchange

- Diversification into a portfolio of investment grade bonds. You are not exposed to any single issuer risk.

- Risk adjusted returns - If you believe the ratings can be relied upon, the ETF offers good risk-adjusted returns of 2.92% net

- Capping of expenses - The bond needs a minimum size to operate efficiently. The good thing is that Nikko AM has capped the expense ratio at 0.3%, hopping that it will attract a decent fund size

Some of my concerns

- Annual dividend payout - The dividend is only paid out only annually. Unlike bonds traded through the OTC market, where you are entitled to the interest (borne by the buyer) up to the date of divestment, the ETF or retail bonds has no such concept. Meaning that if you have held the ETF for 200 days and decide that you need to sell for liquidity, you will need to "forfeit" all the accrued interest as the interest is usually not reflected in the bid-ask spread

- Increasing interest rate environment means that the ETF will be subject to pricing pressures whenever there is a rate hike. This is because the ETF will be fully invested and can only reinvest at a higher rate when the bonds mature. If the manager decide to switch out of the existing bonds prematurely, then it may be subject to market risk too

- Liquidity risk - Given that this is a permanent ETF, there will be no redemption of capital. In other words, Manager has to stay invested at all times as it tracks an index and investors can only sell to market makers or through the market if there is sufficient liquidity. Investors will have to bear that in mind if they want to subscribe for the ETFs

What are the alternatives for retail investors?

The sad truth is .... limited! Hyflux Perps was sold to retail investors because they couldn't sell them to institutions. Hyflux Perps wouldn't get an investment grade in any case. The current batch of retail bonds are issued by property firms, and they would also fail the rating tests.

Alternative 1 - One of the alternatives for retail investors is the Astrea IV Class A-1 Bond. You can see my write-up here.

- Asset-backed securities (Not corporate bonds)

- 5 years maturity, scheduled call date on 14 June 2023

- Rated "A" by both S&P and Fitch

- Pays semi-annual coupon every June and December

- Exposure to 36 PE Funds (592 companies)

- SGD denominated

- Interest rate at launch 4.35%

The price since my "3 chilli ratings" has gone up from $1 to $1.045 (4.5% higher) but the current net yield is still trading at a better projected yield than 2.92% net.

Alternative 2 - Singapore Saving Bonds.

You can refer to the website here. The benefits for SSB are:

- AAA rated

- Pays coupon every 6 months

- Average yield of 2.44% if you hold for 10 years (2.17% if you hold for 5 years)

- No frictional costs and gets back full principal on demand (the following month)

My Chilli Ratings

I am going to give this ETF a "one chilli" ratings - Buy only if you like it. (*note that bond and ETF chilli rating has no pricing expectation as prices are not expected to "pop")

You have to decide for yourself if you like the key features and whether you have any liquidity needs in the short term. This product will be suitable for conservative investors who have spare cash (already maxed out on SSB) and is happy to earn a yield more than the SSB and fixed deposits, but also aware that there will be frictional costs if they want to exit.

Alternatively, you can consider the Astrea IV Class A-1 Bonds if you have no need for the cash until 14 June 2023. At least you can enjoy higher interest rates, get paid twice a year and be assured of being repaid the full principal amount at maturity. The only downside is that the price has gone up by 4.5% and there is no liquidity to buy ...

Happy ETFing

Polling Time

You can do the poll here.

Comments