Dasin Retail Trust ("DRT" or the "Trust") is offering 151,768,900 units at $0.80 per unit of which only 2m units will be available for the public tranche. There is an over-allotment option of 9,343,300 units in the event the IPO is oversubscribed. A separate cornerstone tranche of $25m of units have been offered to China Orient Asset Management and Haitong International Fund SPC.

Its principal investment mandate is to invest, develop income producing real estate in Greater China with initial focus on retail malls. The prospectus is

here and the IPO will close on 18 Jan 2017 at 12pm. Investors need to know that this is registered under the Business Trust and is not a REIT.

Portfolio

The initial portfolio comprises 3 retail properties and DRT will acquire Shiqi Metro Mall by 30 June 2017. The properties are located in Zhongshan City, Guangdong. To help you visualize where the city is, Zhongshan city can forum a "triangle" with Macau and Hong Kong in the Pearl River Delta region. About 66% of the IPO proceeds will be used to acquire the portfolio with the balance repaying existing loans, transaction costs and for working capital.

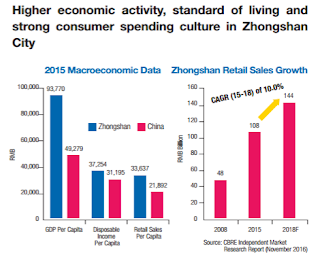

According to the prospectus, there is higher economic activity, standard of living and strong consumer spending culture in Zhongshan city vis-a-vis rest of China.

Sponsor

The Sponsor is Zhongshan Daisin Real Estate Co.., Ltd, a leading developer in the city of Zhongshan. The sponsor is an award winning real estate development company in China and has concluded an extensive "Right of First Refusal" pipeline with DST.

Distribution "Waived"

Distribution waiver, in whatever terms you described it, is a form of financial engineering to me.

According to the prospectus, the Sponsor has selected mature assets as well as younger assets that have yet to reach its potential. The Sponsor waived a portion of its distributions entitlements to ensure investors receive a "market-level" rents immediately... whatever that means.

In layman terms, you can translate it as "The Sponsor has decided to "boost" the yield to comparable China REITs, otherwise, investors will not subscribe to its IPO". The distribution waiver will step down over time and end after 2021.

Based on the waivers, the projected yield will be 8.5% for FY2017 and 9% for FY2018.

Without the Wavier, the yield will drop to 3.8% and 4.7% respectively.

NAV per unit (please correct me if i am wrong)

This is so difficult to find in the prospectus. Assuming the equity (page 152) is RMB 2,702,803,000 and the total number of units outstanding is 549,606,000 (page 137), the NAV per unit in RMB is 4.9 RMB per unit or $1.01 per unit. The IPO price of $0.80 is at a discount to its book value.

What i like about Daisin Retail Trust

- In built rental escalation clauses in Ocean Metro Mall and Xiaolan Metrol Mall as well as expiry of rental free periods for Carrefour at Ocean Metro Mall

- The infrastructure development such as the Shenzhen- Zhongshan bridge and the Hong Kong - Zhuhai - Macau bridge will spur economic development to these 3 regions and will benefit Zhongshan

- Seemingly strong sponsor with long track record

- The CFO of the Trustee-Manager, Mr. Ng Mun Fai, has previously worked at KPMG Singapore and likely to be one of our own. Lol. At least should trust our kaki lang on the financials? The only flip side is he just joined DRT in 2015, hoped he stays...

- The sponsor continues to own ~60% of the malls, providing some alignment of interest

- It is not highly levered, the leverage is around 30.7%

- IPO is at a discount to its book value.

- Ability to attract good tenants across all its malls

Some of my concerns

- Overly concentrated in one city of Zhongshan

- The land leases will expire between 2041 to 2046 compared to the freehold status of malls in Japan (Croesus Retail Trust). While this is "common" in China, I have no idea what will happen when the lease expires after 24 years

- The use of distribution waiver as a form of financial engineering meaning it will offset any potential rental escalations.

- Malls are in pretty saturated market and the behavioral patterns of Chinese consumers are changing with the presence of online malls.

Listed Comps

Dasin is definitely not the first China trust to list on SGX. Let's look at some of its peers. Listed comps include the list below:

- BHG Retail Reit. My write up is here.

- CapitaR China Trust

- Fortune REIT HKD

- Mapletree Greater China Trust

I think the two closest comps will be BHG Retail Trust and Capital R China Trust. BHG launched at the IPO price of $0.80 per unit at the yield of 6.3% (with financial engineering) and had given it a zero chilli rating back then.The price has since dropped to 65c, giving it a yield of 7.75% now and at 0.81x its book value.

Capital R China is currently yielding around 6.6% and at 0.92x book value

My Chilli Ratings

While i don't like the financial engineering, the issuance is priced at 20% discount to its book value and at an inflated yield of 8.5%. This compares favorably to BHG at 7.75% and CapitaR China Trust at 6.6%. I have not done an analysis on how the yield will change as the distribution waiver falls.

I will give it a one chilli rating given its fairness in pricing the IPO. My gut feel is don't expect much fireworks but I don't expect it to drop drastically given its relatively small issuance and fair pricing.

Comments

"discount of approximately 21.4% to the NAV per Unit(1) based on the

Offering Price.". Its quite cheap!

There is a risk in WALE.. the 3 other malls (i.e. Xiaolan Metro Mall, Dasin E-Colour & Shiqi Metro Mall has a WALE of between 5 to 6 years)

What I am not comfortable with is "The Trust Deed contemplates that new issues of Units may occur, and the issue price for which may be above, at or below the then current NAV per Unit. Where new Units, including Units which may be issued to the Trustee-Manager in payment of the Trustee-Manager’s management fees,are issued at less than the NAV per Unit, the NAV of each existing Unit may be diluted."