As we approach the end of 2015, i will continue with the tradition of posting my tikam results.

The tikam post for 2013 and 2014 is

here and you will find the 2012 results

here.

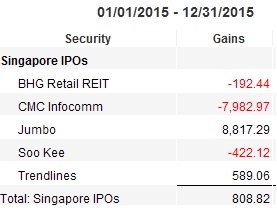

This year is probably one of the worst as the IPO market in Singapore is in doldrums! I made only $808.82 (at least the numbers look auspicious)

There is only one mainboard listing and the rest are all catalist where you can mainly get shares only via placement.

I participated in 5 IPOs this year and the results are as follows:

My biggest losses came from CMC Infocomm of $7,983 while the biggest gain was from Jumbo Group of $8,817. CMC was a "painful" incident where I got "played out" by the backers but i don't blame anyone. As i have said before, you have to be responsible for your own profit and loss so don't blame anyone! ^_^

(including those who lost money on my recommendations. @_@)

Hope 2016 will be a better year for everyone, including SGX who is having a difficult time luring any decent companies to list here.

Since we are only 6 days away to 2016, I wish all readers good health and a joyful and bountiful 2016 in whatever you do!

Comments

Thank you for your contributions over the years! May 2016 be filled with more 8s for you and your readers!