QT Vascular Ltd ("QTV" or the "Company") launched its IPO via placement only for a listing on Catalist. The prospectus is

here. The Company is issuing 196,429,000 shares at 28 cents each. The IPO will close on 25 April 2014 at 12pm and list on 29 April 2014.

The market cap of the Company at IPO price is S$211.6 million. This is 'spectacular' for a loss making company. Let's find out if there are any reasons why.

Principal Activities

The Company is engaged in the design, assembly and distribution of advanced therapeutic solutions for minimally invasive treatment of complex vascular diseases.

I have to tell you that i know "nuts" about this Company even after receiving a 20 minute download from the deal maker except for one key takeaway. For anyone who needs a heart bypass, this Company's products allows for non-invasive treatment and patients recover faster as it "leaves nothing behind" (if i remember correctly). However, I will not pretend to be an expert!

Product Portfolio

This Company somewhat reminded me of Biosensors. A biotech company is as good as the products that has already been developed or are currently in the pipeline. Since i am no bio-tech expert, i will just cut and past the product portfolio below. Hopefully, the biotech sector in Singapore will get a boost from QTV listing and attract more companies here. Example Singapore Exchange is now a hub for oil and gas companies as well as REITs.

Anyway, the certification path is never easy, especially those to be certified by the US FDA. Probably the most "advanced" product in its portfolio is the Chocolate PTA. For those chocolate lovers, hope this will not turn you off. The clinical results are below for your convenience but as in all prospectus, read it with a huge pinch of salt.

Competitive Strengths

The Company listed so many competitive strength. I copy and paste here for your convenience since i have no expertise in this field.

How to validate that QTV's products has potential?

Since i am no expert in this area, who can i rely on to "validate" QTV's potential?

Cordis Corporation

Cordis is a wholly-owned subsidiary of

Johnson & Johnson. J&J is listed on NYSE. Cordis has been appointed as the distributor for QTV for the Chocolate PTA in the United States. J&J is likely to be a potential acquirer of QTV should the Company's products be very successful in future.

Established and Reputable Substantial Shareholders

The 3 substantial shareholders are Three Arch IV LP, Luminor Pacific Fund I Ltd and Biomedical Sciences Investment Fund Pte Ltd ("BMSIF"). BMSIF is a wholly-owned subsidiary of EDB Investments.

Each of Three Arch Partners, BMSIF and J&JDC intends to subscribe for Placement Shares. J&JDC stands for Johnson & Johnson Development Corporation, a wholly-owned subsidiary of Johnson & Johnson and it intends to subscribe for more than 5% of the Placement Shares.

The fact that the substantial shareholders, especially a strategic partner like Johnson & Johnson is willing to invest further in the Company's IPO will provide much comfort to "ignorant" investors like myself. The list of shareholders for your information.

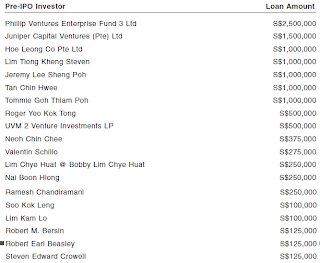

If you looked at the Pre-IPO investors, the "who's who" in Singapore are all there. Are they are in this for a long run or a short flip? Only time will tell. Seemed like the pre-ipo investors are smarter, coming in at around 15.5 cents.

Financial Statements

I will not dwell deeply into the financial results as this is a loss-making company. The US$29m loss for 9M 2013 comprised of net finance costs of US$16.2m which is due to fair value changes on liabilities that hits P&L directly.

Use of IPO proceeds

What I like about the Company

- The Company is in the biotech sector which seemed to be a growing sector

- The products pipeline seemed to be on track for more FDA approvals

- The existing shareholders are not cashing out and are adding new positions. Their average cost per share is close to the IPO price

My concerns

- Whether the products and its future pipeline can receive FDA approval eventually as such certification takes a long time!

- Loss making company with a huge premium over its NTA of 9.6 cents

- Low shareholding held by the CEO and management team

- All the funds investors will want to exit in future!

My Conclusion and Rating

I have already caveat that i know nuts about this sector and i don't really like loss making companies. However, having said that, the demand for the placement shares were very hot during book building. As such it is likely to open above its IPO price. I will give it a 2 Chillis rating purely for hit and run if you managed to get some placement shares at the IPO price. If i have to hazard a guess, the opening range will probably be between 33-38c. Happy IPOing.

Please note that Mr. IPO is vested and will run road at the first instance....

Comments