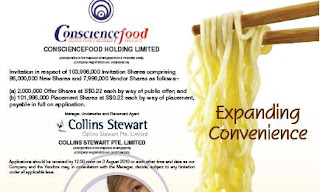

Consciencefood, an Indonesian maker of instant noodles, launched an initial public offer to raise $18.8m.

It is selling 104m shares at 22 cents apiece. The placement of 96m new shares and almost 8m vendor shares represents 26.3% of the company’s enlarged share capital.

Two million shares are available for public subscription, while the remaining 102m will be placed out.

The invitation opened yesterday and will close at noon next Tuesday (3 Aug 2010). Listing and trading of the shares on the Singapore Exchange is expected to start at 9am next Thursday. Collins Stewart is the manager, underwriter and placement agent for the public offer.

This is the "instant noodle food" play primarily in Indonesia. Hence if you are bullish on this sector and country, you should be 'exposed' here. Do note that the barriers to entry is low and there are many "competing brands" in the market.

The bulk of the fund raising is to establish a new manufacturing plant in Jarkarta.

Financially, the company has grown pretty fast over the last few years. Assuming the Service Agreement is in place since 1 Jan 2009 and based on the post-IPO number of shares, the EPS of 2009 will be 2.96 Singapore cents. Based on the IPO price of 22 cents, it is listing at a historical PE of 7.43x. The market cap post listing will be $87.2 million.

The pre-ipo investors are Phillip Ventures, Asean China, UVM Venture and Aventures and they are the main vendors in this IPO. They received their shares based on a 45% discount to the IPO price. (overhang in shares post moratorium 6 months later?)

While it is good to see more regional companies coming to list in Singapore, it is hard to be bullish where most of the IPOs tanked below its issue price post listing in recent weeks.

Comments