Hyflux is offering up to S$300m perpetual securities at 6% per annum with an option to up-size to S$500m ("Perps") and a majority of the Perps are made available to retail investors. The offer will end on 25 May at 12pm.

The key terms are as follows:

**NEW ISSUE: HYFLUX LTD SGD SUBORDINATED PERP NC4 AT 6.00% (SUBJECT TO RESET/STEP-UP FROM AND INCLUDING 27 MAY 2020 AND EACH SUCCESSIVE DATE FALLING EVERY 4 YEARS THEREAFTER) **

ISSUER: Hyflux Ltd ("Issuer")

STATUS: Direct, unconditional, subordinated and unsecured

TENOR: Perpetual NC4

CALL OPTION: To redeem all on 27 May 2020 or thereafter at par

OFFER/ISSUE: Up to S$300m:

$230m Public Offer; S$20m Directors ; S$50m for Institutional

DISTRIBUTION: 6.00% p.a. subject to reset on 27 May 2020 and every 4 years

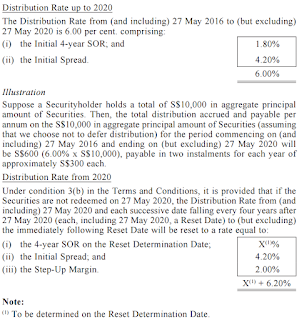

RESET COMPUTATION: Prevailing SGD 4Y SOR plus the Initial Spread plus the Step-Up Margin

INITIAL SPREAD: 420 bps

STEP-UP MARGIN: 200 bps

DISTRIBUTION PAYMENT: Semi-annually in arrear, actual/365 (fixed)

DISTRIBUTION DEFERRAL: At issuer's discretion. Any deferred distributions are cumulative and on a compounding basis

DIVIDEND PUSHER: Yes, with 6 month look back period

DIVIDEND STOPPER: Yes

OTHER REDEMPTION: At par for taxation reasons, accounting reasons, tax deductibility reasons and in the case of minimal outstanding amount

DENOM: S$1,000 each or in integral multiples thereof

MINIMUM SUBSCRIPTION: Public Offer - S$2,000 or higher. Placement - S$100,000 or higher

What are Perpetual Securities ("Perps")

Given that this is the first time i am writing on Perps, i will probably start with the basics for the benefit of myself and newbie Perp investors. Perps is a neither here nor there instruments as it is neither an equity nor is it a bond.

The key features of Perps is as follows:

- hybrid form of securities that combine features of both debt and equity

- ranked lower in priority than holders of bonds or senior creditors

- won't be paid on time if Issuer decides to postpone the payments

- won't be redeemed if Issuer decides not to exercise the call option

If you want a 101 on the key risks of investing in Perps, you can find an old article from Edge

here. The four key risks highlighted in the article are:

- Credit risk - Issuer unable to pay regular coupon and refuses to redeem the bonds after the non-call period

- Interest rate environment - If interest rate rises in future, there could be "mark to market" valuation losses if the Perps trade below par

- Coupon deferral risk - Company may defer paying coupons but the coupons are cumulative in nature and if there is a missed payment, Company will not be able to pay dividends to its shareholders (also known as "Dividend Stopper")

- Liquidity risk - There could be low trading liquidity post issuance and investors may not be able to get out if volume is thin

How institutional investors view Perps?

Hyflux was the first company in Singapore that issued 6% non voting Class A back in April 2011. According to a banker i spoke to recently, investors in Singapore view Perps as a bond and it is supposed to trade like a bond. If Company fails to pay coupon or redeem the Perps at the stated maturity, there will be serious repercussions.

What are the features that will incentivize Hyflux to pay coupons and redeem the bonds on 27 May 2020?

- Dividend Stopper. If Hyflux does not pay the regular coupon, it will not be able to pay dividends to its shareholders. That will result in its share price being suppressed and upsetting its equity investors. The Company paid dividend of 1.7 Singapore cents in FY2015. If the Company is in dire conditions, the board of directors would not dare to endorse any payment of dividends on top the dividend paid on the Perps

- "Punitive" Step-Up interest rate. According to the offering circular, if Hyflux do not redeem the Perps on 27 May 2020, the interest will step up by 2%. Working backwards, the current yield of 6% comprises: SGD 4Y SOR is around 1.80% + the initial spread is 4.2%. Assuming the SGD 4Y SOR remained unchanged, if the Company does not redeem on 27 May 2020, the new interest rate will be 8% per annum. This step up is intended to be punitive in nature so that investors can price Hyflux's Perps as if it is a 4 year bond. As such, there is a lot of repercussions if Hyflux does not redeem the bonds at call date Below is an illustrative example on how the "reset interest rate"works.

I am not too concerned about the 4 year SOR rate. In the event if that crashes to negative, it will probably means the fixed deposit is zero % anyway and 5% is probably a good yield.

Is demand for Hyflux Perps hot?

The Company announced that the placement tranche of $50m was oversubscribed by 4x and they increased the size from S$50m to S$165m. The news is

here.

Have Hyflux Issued other Perps before?

The previous non voting 4m Class A Perps was launched in April 2011 and throughout the ~5 years, it have traded above par. See chart above. The Company has the option to redeem this tranche on 25 April 2018 and interest will step up to 8% if it is not redeemed. My view is that it will be redeemed.

In Jan 2014, the Company issued perpetual capital securities comprising

S$300m bearing interest rate of 5.75% (Issuer can call on 23 Jan 2017 or face a step up) and in July 2014,

another S$175m at 4.8% (Issue can call on 29 July 2016 or face a step up). The two bonds issued in 2014 were for the "wholesale" market. In other words, the bonds were sold at minimum denomination of S$250,000. The links are to the prior Perps issued and you can find more information and charts on fundsupermart. The current issue is the latest made by Hyflux and it is for the retail investors.

Ironically, the charts of the Perps is a big "contrast" to its own share price. I am sure equity investors aren't too pleased about the share price performance. It is currently trading at a discount to its book value.

What is Hyflux's yield curve?

Fundsupermarket has an interesting article. Please go read it

here. In that article there is a Hyflux Yield Curve chart (see below). All the Perps are trading at below 5%. In other words, the current 6% Perps are priced to sell!

Financial Performance

If you want to access the credit risk of Hyflux, you would probably need to refer to the

annual report. The 5 years financial performance is presented below.

The profit has been hovering around the $40-$65m range and the loss per share of 1.05 of FY2015 has adjusted for the effect of the previous Perps.

The Company also announced its Q1 results recently where revenue grew to S$248m. The press release is

here. OCBC also released its research report with hold rating

here. The forecast from OCBC is presented below, which shows a positive EBITDA and net profit.

Can the Company sustain the "dividends"?

The above shows that Hyflyu paid S$24m on the preference shares and $25.65m on the perpetual capital securities in 2015. This will likely "swell" in 2016 post the retail issuance. Assuming a S$300m issuance, the "dividends" will increase by another S$18m per year to around ~S$68m. Based on the EBITDA of S$98 and S$102m for FY2016 and FY2017 (from OCBC), it seemed the interest will be covered for now.

In addition, this issuance is likely to be used to retire the two earlier Perps issued in July 2016 and Jan 2017. As such, the cash needs will drop correspondingly

Order Books

The Company has also announced record order books. It is no wonder that the Company needs to raise cash for these EPC projects. I like the "water" space as it is a scarce commodity and Middle East seemed to be the place to build desalination plants. However, the key concerns will be the Middle East situation with major conflicts due to ISIS and the depressed oil price may result in non-payment for some of the projects. (Go read the Contingencies in the Annual Report).

Why Hyflux want to issue Perps at 6%?

If I put myself in the shoes of Hyflux management, it actually makes good business sense. Issuing equity will be "expensive" and borrowing from Infrastructure funds or project financing banks will probably cost Hyflux between 9%-12% if you look at the

median IRR of infrastructure funds.

Perps are issued when Hyflux has projects on hand and i am assuming governments are good credit customers. In the unfortunate event of projects delay, Hyflux can always "delay" the coupons until the proceeds are received. This delay of coupon payment will not trigger a "default" event vis-a-vis a plain vanilla bonds. In the unfortunate event that the Company needs to raise funds, it can always sell the completed projects to repay the debt.

Mr IPO's view

Based on the above analysis, i quite like the Hyflux 6% Perpetual Securities NC4 for the following reasons:

- Hyflux is an established MNC with a long track record.

- Olivia Lum is a poster child here and her rags to riches story provides inspiration to anyone. Go read it if you want some inspiration! You can easily google for the stories. ^_^

- 6% is not a bad return under current market environment and the non call period of 4 years is about right

- Current issue is priced to sell as similar Perps from Hyflux are trading at ~4%.

- Protective features with decent step up in interest rate ensure redemption is most likely after 4 years

- Issue is priced in SGD. The forex risk is borne by the Company

Please note that Mr. IPO is vested from the placement tranche and is part of his bond ladder portfolio.

Happy Perplexing ^_^

Comments

For the chart of the non voting 4m Class A Perps you posted, it is above par in the period between 2011 to 2016. This period coincide with a low interest rate environment arising from QEs all over the world.

Seeing that US may further increase the interest rate, how much do you think it will affect the price of this issue? Already I see a noticeable drop recently (104 to 102) which I guess is a response to the rumored rate hike in June.

Regards

correct my understanding..

if missed payout for one semi-annual distribution, it will accumlate to the next payout?

and if they miss the payout, they will not distribute to their shareholders?

the risk to the perp holders seem very minimise.

even with SOR 0%, it is pretty much a guaranteed 6% yield.

only downside is the the bond falls below par value.

seems like too good to be true?

Typo? 'two earlier perps' cannot possibly be issued in the future. U mean 'retirement dates' right?

Assuming the company decides to redeem, on redemption date, will the company pay only the principal amount back to the shareholder, or principal plus whatever prorated dividend ?

Please advise. Thanks.

Can you make a guess on the opening price on 30th? ;)

Hyflux's group chief financial officer Lim Suat Wah said the company has a cash balance of S$494 million as at end June 2016 and also recently completed project finance for two major projects.

"There is sufficient cash as well as available lines such that the company does not need to raise additional funds to redeem any maturing facilities," she said.

http://www.businesstimes.com.sg/banking-finance/singapore-mom-and-pop-investors-face-losses-as-bond-risks-spread

~~ No Risk No Return ~~

The 6 per cent perpetual bonds sold to mom-and-pop investors by water company Hyflux Ltd have declined to 95.4 US cents from about 100 US cents as recently as Aug 12, exchange prices show.

Hyflux's group chief financial officer Lim Suat Wah said the company has a cash balance of S$494 million as at end June 2016 and also recently completed project finance for two major projects.

"There is sufficient cash as well as available lines such that the company does not need to raise additional funds to redeem any maturing facilities," she said.

http://www.businesstimes.com.sg/banking-finance/singapore-mom-and-pop-investors-face-losses-as-bond-risks-spread

if what mr ipo said is truth, the dividend will be 10% if you buy from open market now. Worth considering?