Toku Ltd - Balloting Results

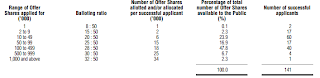

Toku , a Singapore-incorporated AI-powered customer experience (CX) platform, today announced the successful close of its initial public offering. The Company will be listed on the Catalist Board of the Singapore Exchange Securities Trading Limited following the completion of the offering, marking the first IPO of 2026 for the exchange. You may refer to the ballot results below: Sharing the key highlights from the press release, as well as a quote from Thomas Laboulle, Founder and CEO, Toku. Toku, the Singapore-incorporated AI-powered customer experience (CX) platform secures full subscription on SGX Catalist, raising S$16.25 million at S$0.25 per Invitation Share. The Public Offer attracted strong interest and was 31.9 times subscribed , from 1,115 valid applications for 63,888,300 Public Offer Sh...

Comments

Considering that it's only 1.5x subscription, got lucky!