Food Innovators Holding Limited

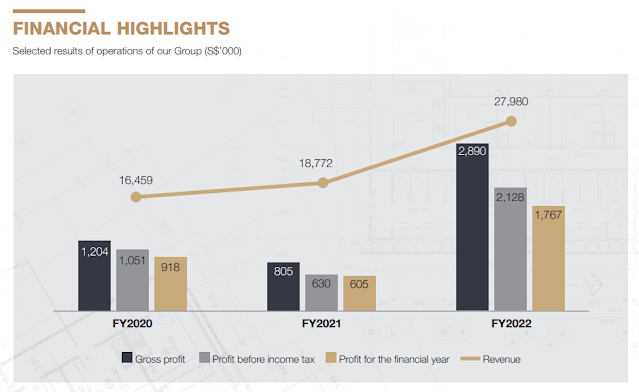

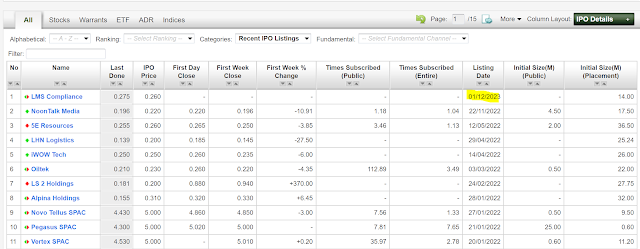

Food Innovators Holdings Limited ("FIH" or the "Company") is offering 14m shares at $0.22 each, for which 13m shares will be through placement and the remaining 1m shares via a Public Offer. The IPO will close on 14 Nov at 12 noon and starts trading on 16 Oct 9am. FIH has two business models - the first is to be a master lease and sublease the space to other tenants and the second is to operate and manage restaurants. The Company currently has 12 restaurants in Japan, 10 in Singapore and 4 in Malaysia. The market cap based on the IPO price is around $24.9m. Financial Highlights FIH's revenue grew from $37.8m in FY2022 to $43.8m in FY2024. It is quite funny to see that being a master land lease holder has a higher margin than operating the restaurants, once again illustrating the point that it is better to be a landlord to shake leg and collect rent. According to the prospectus, the PER is around 19x. The Company intends to pay 20% of its net profit after ...